A lineup of GG Marmont round bags featuring a chain shoulder strap From Gucci Cruise 2019 by Alessandro Michele; photo: @gucci,.com

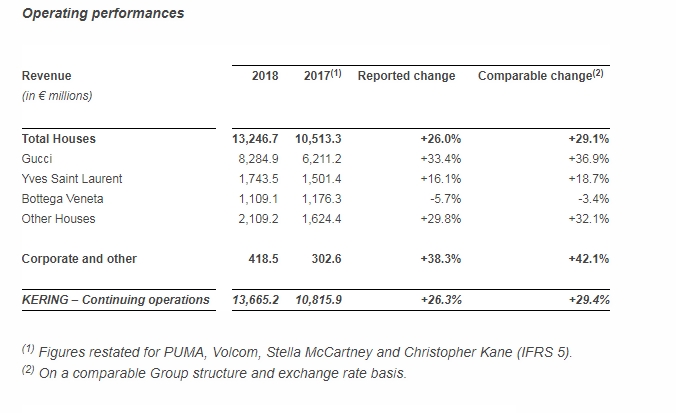

2018 was an excellent year for Kering and its Houses especially for Gucci and Saint Laurent. The luxury group also announced a strong momentum at Kering’s Other Houses (up 32.1% on a comparable basis), powered by Balenciaga and Alexander McQueen.

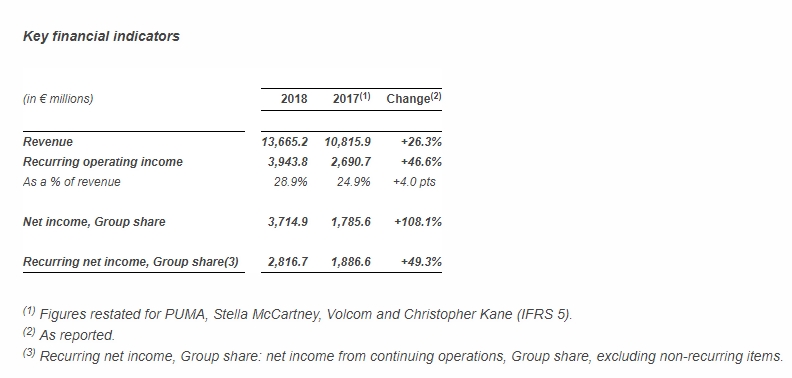

Consolidated 2018 revenue amounted to €13,665.2 million, up 26.3% as reported and 29.4% on a comparable basis. All regions reported very strong growth for Kering, with comparable revenue up 37.8% in North America, 33.8% in Asia-Pacific, 23.9% in Japan, and 23.7% in Western Europe.

According to François-Henri Pinault, Chairman and Chief Executive Office, Kering significantly outperformed the luxury sector.

“In an environment that was generally favorable but grew increasingly complex, Kering generated 2.8 billion euros in incremental revenues and 1.3 billion euros in additional EBIT compared to 2017. Our healthy, balanced and profitable growth reflects skillful execution of our strategy, rigorous financial discipline, and a shared culture emphasizing responsibility and commitment. Having worked throughout the year to strengthen the Group and its brands, we have the ambition and the means to sustain our profitable growth momentum,” commented Pinault.

Gucci: another remarkable performance underscoring brand momentum

Gucci’s revenue topped €8 billion in 2018, rising 33.4% as reported and 36.9% on a comparable basis to €8,284.9 million. This excellent performance, in line with the prior year, reflects healthy and balanced growth in all regions, product categories and client segments. Sales through the brand’s directly operated stores rose 38.3% in 2018, fueled by increasingly higher traffic and enhanced productivity. Online sales surged 70.1%. All regions reported very strong growth figures, led by Asia- Pacific (up 45.0%) and North America (up 43.6%). Wholesale climbed 30.7%.

The robust rise in revenue in the fourth quarter of 2018 (up 28.1% against a very high base of comparison) illustrates Gucci’s continued brand appeal.

Gucci’s 2018 recurring operating income totaled €3,275.2 million, up 54.2% while maintaining ongoing investments, reflecting the brand’s systematic implementation of initiatives aimed at supporting sustainable, profitable growth. The brand’s recurring operating margin widened by 530 basis points to a record 39.5%.

Yves Saint Laurent: further sustained growth

Yves Saint Laurent turned in another remarkable performance, thanks to strict and effective execution of its strategy. 2018 sales rose 18.7% on a comparable basis and 16.1% as reported. In directly owned stores, sales were up 18.5% on a comparable basis. Yves Saint Laurent notched up revenue increases across all major regions in 2018, with North America (up 26.8%) and Asia-Pacific (up +21.2%) particularly strong. Wholesale climbed 20.9% on a comparable basis.

The luxury fashion house confirmed its excellent momentum in the fourth quarter of 2018, with revenue up 19.4% on a comparable basis.

2018 Recurring operating income at Yves Saint Laurent was 21.9% higher as reported at €459.4 million, while recurring operating margin exceeded 26%.

Bottega Veneta affected by the change in creative direction

Bottega Veneta’s revenue in 2018, a year shaped by the arrival of a new Creative Director, was down 3.4% on a comparable basis and 5.7% as reported. Revenue generated through directly operated stores dropped 4.7%, impacted by slower tourism, in Western Europe in particular. Comparable sales generated through the wholesale network were up 2.8%.

The House’s sales were down 3.2% in the fourth quarter of 2018. However, the response to the 2019 Pre-Fall collection unveiled to the press and to buyers late in the year was very encouraging. This initial stage in Bottega Veneta’s transition will be followed in late February by Daniel Lee’s first show during Milan Fashion Week.

Bottega Veneta’s recurring operating income was 17.7% lower year-on-year at €242 million, with the brand selectively stepping up investments in order to prepare its new positioning. Recurring operating margin was 21.8%.

Revenue from Kering’s Other Houses passed the €2 billion mark in 2018, totaling €2,109.2 million, an increase of 29.8% as reported and 32.1% on a comparable basis. This excellent performance was led by Couture & Leather Goods, while Watches & Jewelry also posted solid revenue growth.