The Estée Lauder Companies continue to see strong consumer demand for its high-quality products.

The Estée Lauder Companies reported exceptional financial results for its second quarter ended December 31, 2019. Net sales of $4.62 billion increased 15% from $4.01 billion in the prior-year period. Excluding the impact of currency translation, net sales increased by 16%.

Net earnings were $557 million, compared with $573 million last year.

Fabrizio Freda, President and Chief Executive Officer said, “We delivered superb results in our second quarter, leading to an excellent first half. Our multiple engines of growth generated broad-based gains across all our regions and major categories, as our prestige brand portfolio was well received by global consumers during the Singles Day event and holiday season.

“Our sales growth came from all facets of our business, including the Asia/Pacific region, the skin care and fragrance categories, the online and travel retail channels, and the Estée Lauder, La Mer and luxury fragrance brands. Our emerging markets continued to be vibrant and we made progress towards the stabilization of our North American business despite continued softness in the makeup category. Additionally, we completed the acquisition of the Korean-based Dr. Jart+ brand at the end of the quarter, which strengthens our position in global skincare.”

Freda emphasized, “In the wake of the recent coronavirus outbreak, we are first and foremost concerned about the health and safety of our employees, consumers and everyone affected in China and around the world. Our hearts and support go out to the many people working hard to mitigate the health risks of the coronavirus. The global situation will also affect our financial results in the near term, so we are updating our fiscal year outlook. With our results to date and our agility in allocating resources, we will strive to deliver full-year growth at least in line with our long-term goals, even in this challenging moment. We will be ready to return to our growth momentum as the global coronavirus outbreak is resolved.”

Skin Care

Skin care net sales grew across all regions, led by Estée Lauder and La Mer. Origins and Clinique also grew globally.

The Estée Lauder brand delivered growth in all regions and every major channel, reflecting continued strength across several of its core product franchises, such as Advanced Night Repair, Perfectionist, Re-Nutriv, Revitalizing Supreme+ and Micro Essence, supported by successful innovations and strong holiday campaigns.

Double-digit growth from La Mer was broad-based, with net sales increasing across every region and major channel, driven by higher net sales of existing products, as well as the relaunch of The Regenerating Serum. Targeted expanded consumer reach, large scale influencer activations and strong holiday programs also contributed to growth.Origins net sales benefitted primarily from growth in the brand’s treatment lotions and moisturizers, such as Dr. Weil

Mega Mushroom Treatment Lotion and Serum.

Clinique’s growth was driven by increases in its hero franchises, including Smart and Moisture Surge, which also drove growth in Europe and travel retail.

Operating income increased sharply, primarily from Estée Lauder and La Mer, reflecting higher net sales.

Makeup

Net sales growth in makeup was primarily driven by increases from Estée Lauder, Tom Ford Beauty, Bobbi Brown and La Mer. These increases were partially offset by lower net sales primarily from BECCA and Smashbox.

Estée Lauder generated solid double-digit growth, driven by strength from its Double Wear line of products and initial shipments of Futurist Hydra Rescue Moisturizing Makeup SPF 45, as we expanded distribution beyond Asia.

Net sales from Tom Ford Beauty increased double digits, primarily driven by its eye shadow and cushion compact products in Asia/Pacific, as well as targeted expanded consumer reach.

Bobbi Brown’s double-digit growth across Asia/Pacific and Travel Retail was largely driven by the continued success of its Intensive Skin Serum Foundation and the launch of Luxe Shine Intense Lipstick.

La Mer’s strong double-digit growth was driven by successful holiday events and campaigns.

Makeup operating income declined, primarily reflecting goodwill and other intangible asset impairments related to Too Faced, BECCA and Smashbox. Strategic investments to support initiatives at M•A•C also contributed to the decrease. These were partially offset by increases from Estée Lauder and La Mer, reflecting their sales gains, as well as disciplined expense management from Clinique.

Fragrance

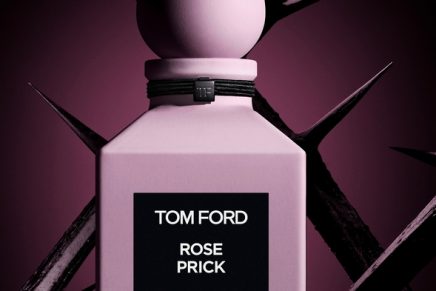

Net sales growth was driven primarily by increases from Jo Malone London and Tom Ford Beauty.

Jo Malone London’s double-digit net sales increase primarily reflected strong holiday activations, the launch of Poppy & Barley and targeted expanded consumer reach.

Increased net sales from Tom Ford Beauty reflected the continued success of certain Private Blend fragrances and the launch of Métallique.

Fragrance operating income growth was driven primarily by higher net sales and disciplined expense management.

Hair Care

Hair care net sales grew at both Aveda and Bumble and bumble. Aveda net sales benefitted from the launch of Nutriplenish, a new line of hydrating hair care products. In addition, Full Spectrum Demi Plus and the relaunch of Sap Moss also contributed to net sales growth.

Hair care operating income declined, reflecting marketing support for Aveda’s new and recent launches.