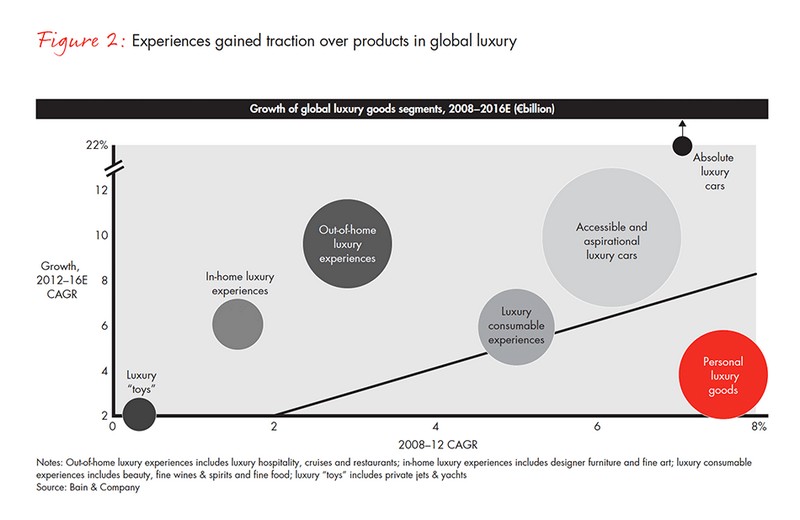

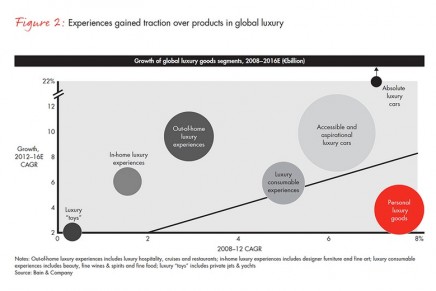

The beauty, fine wines and spirits, and fine food segments all grew, reflecting a redirection of luxury spending away from goods and toward personal pampering and experiences.

Last 12 months, the luxury consumption shifted away from goods and toward experiences such as travel and gastronomy, which grew faster than luxury goods by at least 5 percentage points.According to the latest Bain‘s Luxury Goods Worldwide Market Study, Fall-Winter 2016. The best-

performing categories were luxury cars, luxury hospitality, fine wines and spirits, and fine food.

The 15th edition of the Bain Luxury Study, published by Bain & Company for Fondazione Altagamma, the trade association of Italian luxury goods manufacturers, analyzed recent developments in the global luxury goods industry.

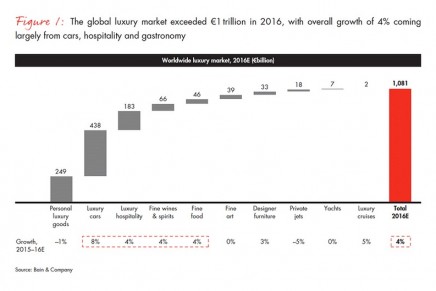

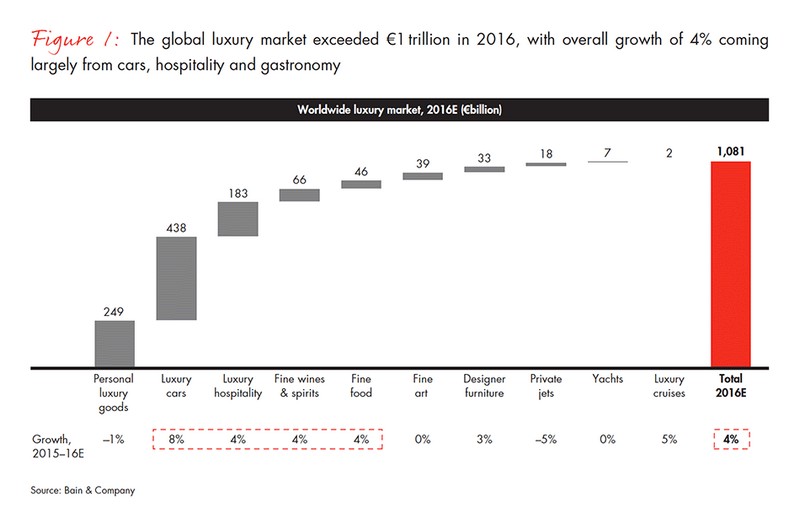

The overall luxury industry tracked by Bain & Company comprises 10 segments, led by luxury cars, luxury hospitality and personal luxury goods, which together account for approximately 80% of the total market. The overall industry has posted steady growth of 4%, to an estimated €1.08 trillion in retail sales value in 2016. Yet among specific categories, there was a clear spread in this past year’s performance.

Luxury cars remained the top-performing segment (growing 8%), particularly in the very high end of the market, within which sales were strong in China.

Luxury hospitality (up 4%), luxury cruises (up 5%) and fine restaurants all benefited from growth in luxury travel.

The private jet market contracted, and yacht sales stagnated; unlike luxury cars, neither segment has been able to benefit from growing demand in China.

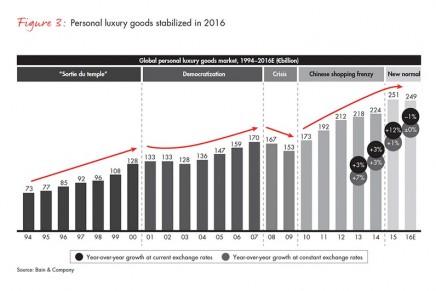

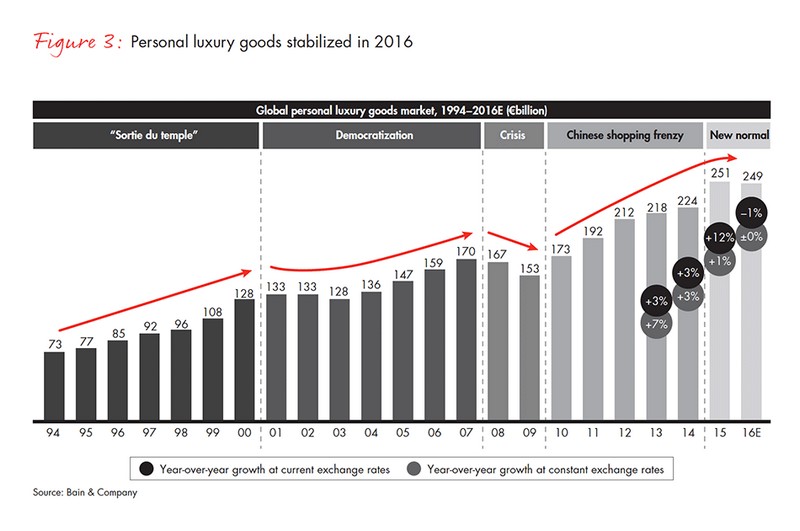

This is the third consecutive year of modest growth at constant exchange rates, and it represents a new normal in which luxury companies no longer benefit from a favorable market and free-spending consumers. Brexit, the US presidential election and terrorism have all led to significant uncertainty and lower consumer confidence, hindering sales of personal luxury goods. In this environment, companies no longer grow and generate profits merely by riding favorable economic tailwinds. “Instead, we will see clear winners and losers,” says Bain& Company.

Luxury Goods Worldwide Market Study: Regional highlights

- Among regional markets, only Japan grew in 2016, up 10% at current exchange rates. The Americas, which remains the largest global market for personal luxury goods, contracted by 3%, as did Asia (excluding Japan). Europe shrank by only 1%.

- In Europe, Bain & Company analyzed data from Global Blue, a company that tracks tax-free shopping in Europe. Major markets of Germany, France and Italy saw declines in tax-free spending. The UK was a bright spot, with 8% growth in 2016 following the post-Brexit depreciation of the British pound, which attracted shoppers to the UK.

- At current exchange rates, China contracted to €17 billion in 2016, representing a 2% decline. Growth rates had historically been strong in China—19% from 2007 through 2014. But since 2014, China has seen a more modest performance. However, in 2016, at constant exchange rates, the market grew 4%, the first sign of a revitalization in three years.

- Globally, were it not for purchases from Chinese consumers, the overall global market for personal luxury goods from 2012 through 2015 would have contracted by an average annual rate of 2%. However, for the first time in the past decade, Chinese consumers have slightly decreased their contribution to the total luxury market—from 31% in 2015 to 30% in 2016.

- The long-term outlook remains positive, thanks to a large and growing middle class in China with more disposable income for luxury purchases.

- Beyond personal luxury goods, Chinese consumers increased their spending in categories such as luxury cars, fine food, luxury hospitality and designer furniture, while holding steady in fine art, private jets, yachts and luxury cruises, and declining in fine wines and spirits.

Distribution trends

The wholesale channel still dominates, with roughly two-thirds of total global sales in 2016. Retail continues to grow steadily, however, to its current high of 35% of the total market. Since 2008, the retail channel has expanded at a CAGR of 11% vs. 3% for the wholesale channel. Monobrand stores, department stores and specialty stores still represent the highest-volume formats, with approximately 74% of the market. All three showed negative growth from 2015 to 2016, however, and department stores in particular appear to be in a structural decline. By contrast, channels such as off-price stores, e-commerce and airport stores all showed strong growth in 2016, albeit from a smaller base.

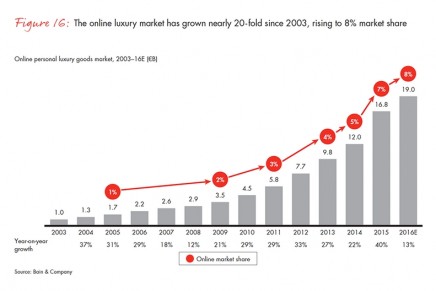

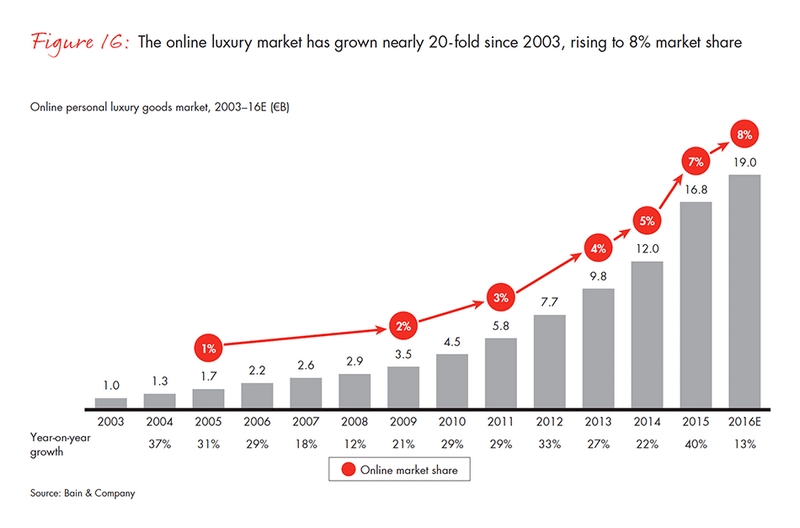

Online sales have shown especially strong growth in the personal luxury goods market, increasing nearly 20-fold from 2003 through 2016, to the current level of €19 billion (or 8% of the total).

In 2016 alone, the market for online luxury goods grew 13%, significantly outperforming the rest of the personal luxury goods market.

Off-price stores now represent 11% of the market for personal luxury goods, up from just 7% in 2013. That growth is especially strong in Asia and (to a lesser extent) North America—both of which saw a strong expansion in the discount channel footprint. Yet brands were able to exert more control over markdowns. Rather than end-of-season sales and other ad hoc approaches, retailers are adopting a more strategic approach to managing outlets and actively seeking to reduce discounts in stores (in part by educating wholesale partners).

Airport stores make up 6% of the market, with growth in the high single digits in 2016. Slowing tourism has impacted growth, but that effect has been less severe in some markets. Asia is still leading the growth trend for airport stores.

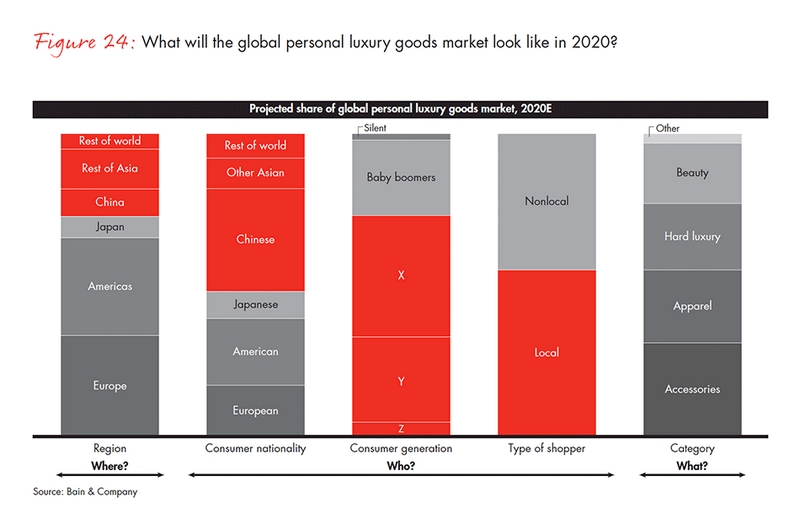

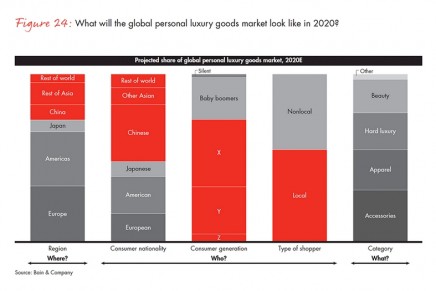

“We expect the market to grow at 1% to 2% in 2017 and a 3% to 4% CAGR through 2017 to 2020, to approximately €280 billion (at constant exchange rates),” predics Bain & Company. “The rising Chinese middle class should continue to spur growth in luxury goods purchases, along with a

recovery of consumer confidence in mature markets (including larger contributions from Generations X and Y). Markdowns will remain a sizable component of the market, but companies will handle them in a healthier and more strategic manner, reducing sales cannibalization. No category or segment champion will dominate, but digital will remain the clear leader among distribution formats,” says Bain & Company speaking about its outlook for the future.

Individual category performance

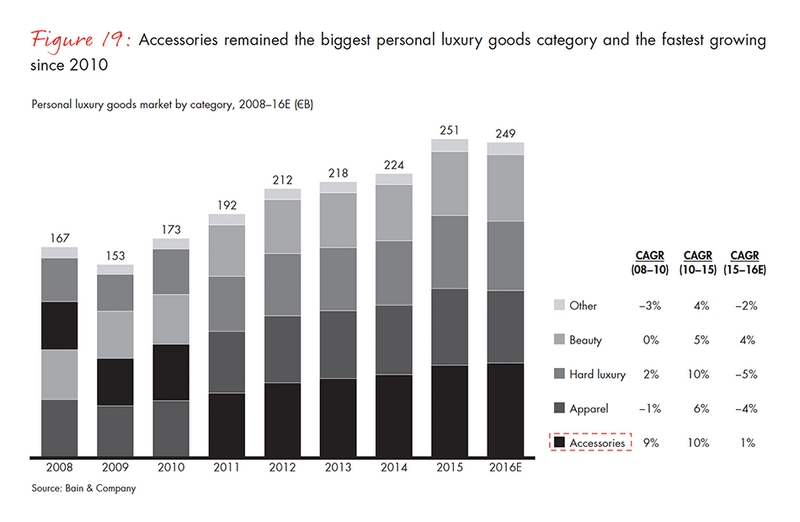

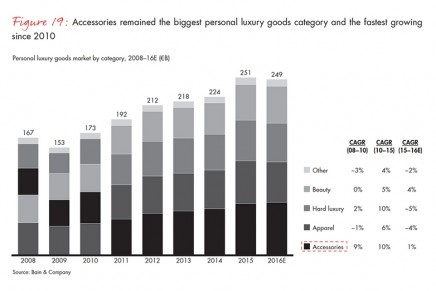

Over the long term, accessories have dominated in terms of both market share and growth rate (up 10% p.a. from 2010 to 2015). However, the category’s performance decelerated from 2015 to 2016, to 1% growth. Within accessories, the two largest segments—handbags (€44 billion in retail sales value in 2016) and shoes (€16 billion in 2016)—grew moderately at 2%.

From 2015 to 2016, the beauty category showed brisker growth at 4%, led by makeup and fragrances. The strongest markets were Asia and the Americas.

In the fashion accessories category, leather goods and shoes showed a clear shift in favor of entry-priced goods such as backpacks and sneakers. In apparel, there is a growing dichotomy between large specialists and smaller, more dynamic lifestyle brands. Casual apparel is gaining traction, leading to growth in areas such as luxury denim, down jackets and activewear.

The watch market continued to struggle (down 8% from 2015 to 2016), especially for higher-end products in Asia.