As the watch industry is trying to find its future in ultra-niche and luxury products, a small group of watchmaking brands have the unique power to constantly capture the luxury consumer spend. Fine watches became another investable commodity. But does that make them a good investment?

In a world of unpredictable and accelerating change, fine watches are seen as a safe investment in terms of holding value. It is more practical to invest regularly in high-end watches. As nytimes notes, the next-generation collectors see old timepieces not just as a subtly stylish way to accessorize an outfit, but also as a hot new asset in their investment portfolios. Part of highly important private collections, the exclusivity and desirability of these watches is further enhanced by their spectacular all original condition.

Rocket fuel: Strong watch brands propel themselves.

The reduced spend on travel, dining or other experiences during the year created significant opportunities for watches and jewellery. These products, says De Beers, are filling the temporary void left by travel in the way few other luxury products can.

According to Swiss watch industry statistics, the luxury watchmakers have weathered this year’s storm far better than the rest of the players. “Audemars Piguet, Rolex, Patek Philippe or Richard Mille belong to families or foundations that do not focus on driving sales. On the contrary, these luxury brands control their production in a targeted manner, artificially creating shortages in the market. The result: waiting lists for the most sought-after models and buyers who pay steep surcharges to get their dream watch immediately.”

Rolex rules resale but it is also on top positions in investors’ online searches. Google Trends’ data shows that Hublot, Rolex, Tudor, Omega, IWC, and Tag Heuer are the most-googled watch brands over the last five years – a possible performance indicator in terms of sales and profitability.

Fine watches are great money makers.

Rolex sport models remain the most sought-after pieces in 2020, says eBay’s 2020 Luxury Watch Report. The report confirms the strength and staying power of the current pre-owned market. Omega, Breitling, TAG Heuer, and Patek Philippe continues to dominate on eBay in terms of sheer sales volume. The watch-collectors and buyers have become more comfortable making even extremely large purchases online. According to the extensive research done by online casino betway, limited-time sales deals on highest-selling brands, offer the chance to generate your own positive momentum by re-investing your profits in some pre-owned models from the best-performing watch manufactures.

Breathtakingly rare: Top 10 most expensive watches of all time

The heritage of complications, the never-seen-before technical achievements, joined by rare materials, and exclusivity are the main factors determining the price of a timepiece. In the portfolio of world-class wristwatches, few can come close to matching the amazing rarity and beauty of the top 10 unique creations.

For decades, this ranking is topped by the same champions: Patek Philippe, the last family-owned Genevan luxury watch manufacturer and Rolex, the Swiss luxury watch manufacturer based in Geneva.

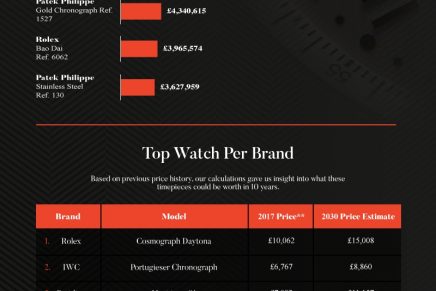

Patek Philippe Grandmaster Chime, the most complicated Patek Philippe wristwatch ever made, holds the title of the most expensive timepiece (see the infographic below to find out the top timepieces that are worth eye-watering money today). This unique watch boasts twenty complications, a reversible case, and two independent dials, and six patented innovations. Last year, Patek Philippe Grandmaster Chime 6300A-010 was sold for over $31 million, the highest price ever paid for a timepiece at auction. The previous record for the most expensive timepiece was set by a 1932 Patek Philippe watch, which sold for $24 million at a 2014 auction at Sotheby’s in Geneva.

Buying a Rolex is equivalent to purchasing stocks in top-performing companies. Owning a Rolex Paul Newman Daytona is owning the holy grail of vintage Daytona collectors. Patek Philippe Stainless Steel Ref. 1518 retains the third position in the top, followed by another unique and important Patek Philippe. The watch is named Gobbi Milan “Heures Universelles” Ref. 2523. It is the only known reference 2523 to be double signed with both Patek Philippe’s signature and that of the prestigious Milan retailer Gobbi. Only one other single-signed example is known to exist.

Transcending time: Top watches that have appreciated the most value over time

The majority of watches out there are not investment grade. So which watches hold their value and which brand of watches is best for investment? As a serious investor, you are curious to know what your timepieces could be worth in a decade. Choose what watches make you money based on 2030 price estimates, information from watch-collecting circles, and insiders based on marketplace data. Based on price history, Rolex Cosmograph Daytona, Tag Heuer Carrera Calibre 1887 Chronograph, and Breitling Navitimer 01 are the top three models those value is expected to rise on a constant basis.

A watch collection with an IWC Portugieser Chronograph, Tudor Pelagos, Omega Seamaster Planet Ocean, or a Hublot Classic Fusion Chronograph is predicted to perform very well in the next 10 years, with a 10-30% net yearly return on your investment.