No longer a luxury sector of spas, yoga and detox diets, the global wellness economy is worth US$4.5 trillion and is growing twice as fast as the rest of the economy.

Consumers expect every brand to contribute to their wellness. And 59% agree it’s worth paying more for wellness options.

Ogilvy surveyed 7,000 consumers from 14 countries across 4 continents to gain new insight into how they see wellness in 2020 and to help marketers close the glaring opportunity gaps as they look to growth their businesses. This global research was conducted in April 2020 at a time when wellness declined rapidly for many, placing an increasing significance on wellness as we move into 2021.

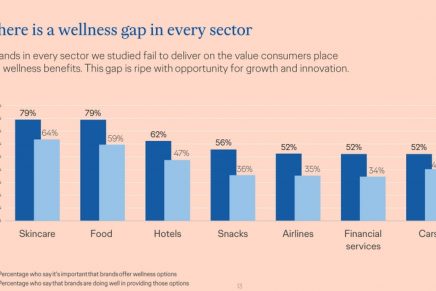

The US$4.5 trillion global wellness economy – growing twice as fast as the global economy – is now so pervasive that for 73% of global consumers, wellness is now considered an essential element of a brand’s strategy. The Ogilvy Wellness Gap study released this week has, for the first time, quantified the gap between consumers’ wellness expectations of brands and how they judge delivery against those expectations in seven key sectors – food, snacks, skincare, airlines, hotels, cars and banking.

In 2020, 77% of people say wellness is very or extremely important to them. Yet, consumers are still hungry for more: Hungry for more wellness—80% of people want to improve their wellness; Hungry and expecting—75% feel brands could do more for their wellness; Hungry and frustrated—only 46% feel that brands take their wellness as a priority.

Take major wellness industries like food and skincare, which have innovated and grown around wellness for the last two decades. Yet only 41% of global respondents agree the food sector and 53% agree the skincare sector is doing all it should to help them with their wellness.

Every brand can be a wellness brand now.

“Wellness is in many ways the more tangible benefit of ‘purpose.’ We think this is very good news for brands. It shows that wellness remains an opportunity for double digit growth by meeting numerous consumer expectations to close the gap,” said Marion McDonald, Ogilvy’s Global Health & Wellness Practice Lead.

Discussing the implications of the study, Benoit de Fleurian, Ogilvy’s Global Planning Lead for Health & Wellness said, “Wellness has created new conversations, new expectations, new purposes – both for companies and individuals. Wellness has inspired new businesses, new brands, new products, new services, new experiences. Wellness has seen companies pivot their strategy, business and portfolio. Wellness has started to revolutionize entire

industries, starting with the food and beverage industry.”

Another important conclusion of the report is that every brand can grow through wellness. Wellness is no longer a luxury sector of spas, nor the preserve of wellness brands; consumers are very clear about it:

- 73% say brands need a wellness strategy as part of their core mission;

- 67% say there should be more wellness options, regardless of what they are shopping for;

- 52% expect cars, banks or airlines to offer wellness options—almost equal to the snack foods category (56%);

- Consumers expect every brand to contribute to their wellness. And 59% agree it’s worth paying more for wellness options.

Read the full report here.

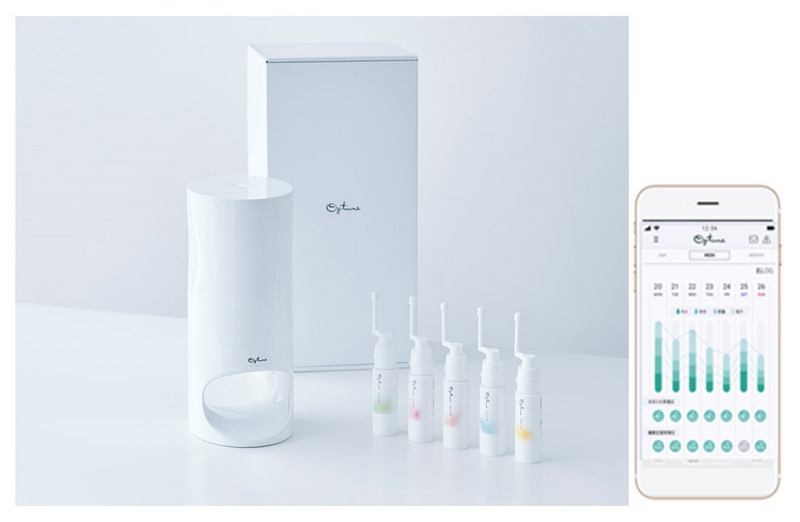

Customised skincare.

Wellness skincare brands are educating their users in the world of formula customisation. The realisation that “one size fits all” doesn’t really fit anyone to degrees of customisation ranging from skin app analysis to the use of epigenetics to formulate your unique serum.

Shiseido Optune, launched only in Japan so far, uses an app to analyse and custom blend your skincare formula daily. Other brands such as Atolla, Atypical and Proven use survey data to send you monthly personalised formulas. Clinique ID allows you to customise a formula at the counter, or online.

Epigenetics is the science that behind the concept of switching ageing genes off and activating the genes to speed cell regeneration. Together with skin microbiome analysis, epigenetics powers customised skincare to potentially impact cellular health. To date, few brands are truly personalised in this space, using a common formula, but their skin wellness claims are more than skin deep.