The trends impacting the UK retail banking industry.

@bank of england; @bankofengland.co.uk

According to SpendEdge’s latest report, the UK retail banking industry is expected to change significantly due to increasing customer expectations, changing regulatory requirements, new competitors, and technologies. Banks need to keep an eye on these factors and evaluate their impact on organizations. Also, they need to integrate changes in markets, customers, risk regulation, and operations while implementing real-world large scale-change.

Cybersecurity

Cybersecurity has become a prime concern for the retail banking industry. The advent of new technologies is exposing customer data to greater risks and creating new challenges for banks. The industry needs some proactivity to keep up with the threats and secure the data. There have been several attempts of data breaches in the last few years, and many of them succeeded. To know how you can secure the data of your customers, get in touch with SpendEdge experts.

Customer-centric thinking

Banks are increasingly using AI chatbots and live chats to improve their customer services. They are applying predictive analytics to translate the information gained into bespoke user tips by analyzing users spending patterns. This is revolutionizing debt collection and helping customers to manage their transactions.

Blockchain

This technology allows multiple parties to access digital ledger. Organizations in the retail industry are increasingly leveraging blockchain technology to transform their business operations. Also, many banks are acting as a venture capitalist for blockchain companies and helping them raise millions of dollars.

Commercial Banks Embracing Artificial Intelligence but Struggle to Use It for Competitive Impact, According to Genpact Research

Nearly all (97%) commercial banks are using artificial intelligence (AI), according to new research from Genpact, a global professional services firm focused on delivering digital transformation; however, most financial institutions are not implementing the technology effectively for competitive advantage.

Genpact’s study, Commercial Banking: The Customer Experience Imperative, surveyed 500 senior commercial banking executives on the industry’s changing landscape. The research reveals that while many banks understand the growing importance of CX and AI, questions remain regarding their ability to use AI for greater value and mine data effectively to embrace digital transformation and enhance service.

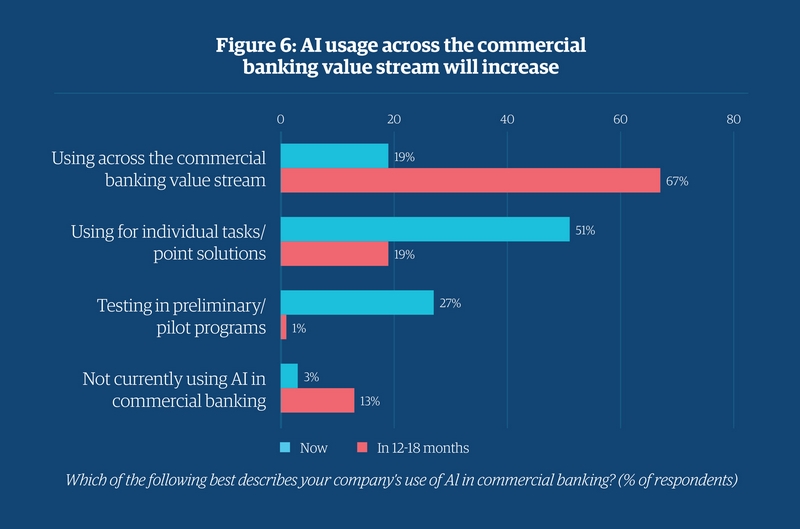

The good news is most banks are optimistic about the future. Two-thirds of respondents say they expect to use AI across their organization in the next 12 to 18 months, compared with fewer than one in five today. Yet, some executives surveyed seem hesitant about whether AI will deliver on its promises to drive new personalized services to improve customer experience. Notably, 13% say their organizations have no plans to use AI in the next 12 to 18 months, up from 3% today, which may suggest a lack of confidence in current pilots and long-term execution.

“With digital technology opening new access to sales and payment data, non-traditional players have leapfrogged many established commercial banks in delivering quality customer experiences,” said Mark Sullivan, global business leader, Banking and Capital Markets, Genpact. “Banks must do a better job at anticipating and quickly incorporating CX innovations. AI can be a major driver given its ability to interpret droves of data to develop highly- tailored solutions that businesses want.”