A Thriving Luxury Secondhand Market Drives Sustainable Consumption. The Consumers Behind Fashion’s Growing Secondhand Market Survey

Sustainability, one of the ways luxury brands can benefit from the growing resale market, says a new survey by Vestiaire Collective x BCG.

Vestiaire Collective, the leading global community platform for desirable preowned fashion, and Boston Consulting Group have partnered for the second year running to release a new survey, The Consumers Behind Fashion’s Growing Secondhand Market, exploring the evolving dynamics of the global resale market. The survey—of 7,000 individuals from six countries—reveals the diverse customer attitudes and behaviors of its respondents, the growing importance of sustainability—among other drivers—in driving the resale boom, and some of the ways luxury brands can benefit from the growing resale market.

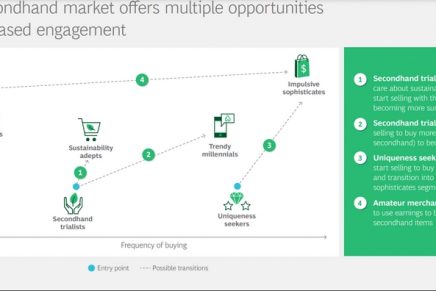

The resale market is currently estimated to be worth $30 to $40 billion, with the market predicted to grow by a CAGR of 15% to 20% globally over the next 5 years, and even higher in developed markets, which could see a 100% YoY growth. The expansion is being driven by an increase in the number of customers starting to buy secondhand and by the number of secondhand pieces consumers are purchasing. Combined, these developments are leading to a share of secondhand clothing in people’s closets that is predicted to grow from 21% in 2020 to 27% in 2023.

The Consumers Behind Fashion’s Growing Secondhand Market Survey by Vestiaire Collective x BCG; @Boston Consulting Group

Accelerated Consumer Trends.

Although affordability, selection availability, and item uniqueness have contributed to the growing popularity of the secondhand market, the survey reveals that consumers’ mounting environmental concerns are also contributing to the secondhand market’s growth. This shift has been further accelerated by the pandemic, with 70% of respondents in 2020 saying they feel compelled to shop for preowned goods in an effort to become more sustainable, compared with 62% in 2018.

The survey also reveals shoppers’ wants: to own fewer, better pieces; to reduce overconsumption; and to take better care of what’s in their closets. The presence of a thriving preowned market encourages all three goals.

- The Upscale Effect: “Buy Fewer, Better Items.”

85% of preowned buyers participate to reduce overconsumption by trading up fast fashion to fewer, higher-quality, longer lasting items. - The Durability Boost: “Take Greater Care of My Things.”

70% of fashion consumers say that the existence of a secondhand market encourages them to take better care of the items they own. - The Circular Life Cycle.

60% of sellers would have not given a second life to their pieces without the secondhand market.

There are many ways luxury brands can capture value from the preowned boom, bearing in mind that more than 62% of consumer respondents said they would be more willing to buy from fashion brands that partner with secondhand players.

Potential benefits include:

The ability to respond to growing consumer desire for purpose-led organizations, as 60% of consumers want to buy from companies of this type.

Customer acquisition, considering that consumers discover brands through secondhand shopping; among those surveyed, 48% purchased a brand that was new to them through secondhand channels in the past year and would consider buying the same brand again.

Customer loyalty because the secondhand market represents an opportunity to get sellers to buy additional items with the money they earned from their sales; 31% of market participants operate this way.

With 69% of consumers willing to consume more secondhand pieces in the future, the preowned market looks poised to address consumers’ growing desire for wardrobes that are unique, of good value, and sustainable.