10 Important Strategies When Buying a Luxury Home

If you make a lot of money or come into an inheritance, one of your first major purchases will likely be a luxury home.Buying a nice, large home in a great neighborhood can significantly increase your quality of life, and give your family the comfortable living space they deserve.

However, even if you have ample disposable income, buying a luxury home is still an important financial decision, andyou’ll need to plan that decision carefully if you want to be successful.

Tips for Buying a Luxury Home

Follow these tips if you want a better experience buying a luxury home:

-

- Be prepared to look for unlisted properties. Many times, luxury home sellers keep their properties unlisted to protect their privacy. This is a savvy move that can prevent you from dealing with tire kickers and unwanted attention.However, it can make it more difficult for buyers to find property. Instead of only looking at listed properties, be ready to find and review unlisted homes.

-

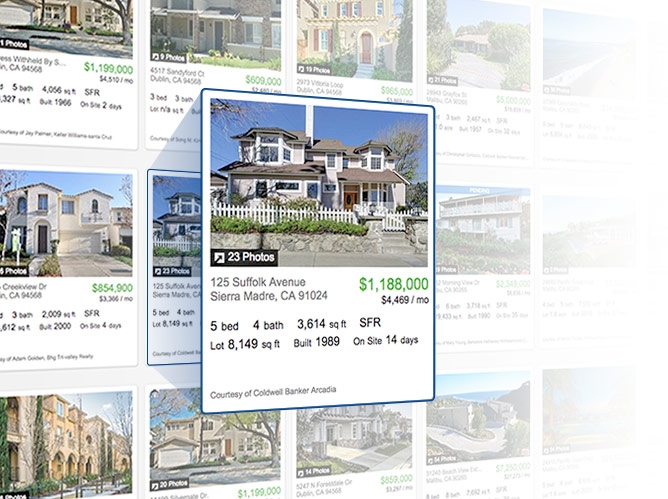

- Don’t assume photos are telling you the full story. Luxury homeowners can afford to hire professional photographers to make their home look as beautiful and spacious as possible. And to be sure, many luxury properties do look amazing both in photographs and in real life. However, you should be wary that photos can be deceptive. Always tour the home in person, and be prepared with realistic expectations.

-

- Get a home inspection. No matter what, you should always get a home inspection. No matter how good a home looks on the surface, there may be hidden points of damage or other long-term issues lurking beneath. Your home inspector will review the home with you from top to bottom, noting anything that should be fixed or that may compromise the long-term value of the home.

-

- Work with a local agent. Try to work with a local real estate agent who knows your city and local neighborhoods inside and out. Working with a buying agent is always a good idea because they can help you find unlisted properties and discover homes that meet all your needs. The local familiarity is an added bonus that can help you make a wise final decision.

-

- Establish a good rapport with your bank. Choosing a property is a big decision, but don’t forget—you’ll also need to find a good loan. The best way to do that is to establish a good rapport with your bank and prepare your finances in advance as much as you can; that may mean liquidating some assets to free up cash for your down payment.

-

- Document as much as possible. Throughout the process, it’s wise to document everything you can. Pay attention to how the property looks throughout your various tours, and get any and all agreements in writing. This will protect your financial investment, and could help you learn from the buying experience so you can buy even better properties in the future.

-

- Consult with multiple advisors. Your buying agent will help you make the right decision, but their perspective is still influenced by personal biases. It’s important to get the opinions of multiple advisors, including other property investors, before finalizing your home purchase. The decision is ultimately yours, but you’ll make a better decision if you have opinions and insights from multiple experienced people.

-

- Consider title insurance. Title insurance will protect your rights to the property in case there’s a defect in the title to the property. If there is a claim or lien for the property, title insurance will have you covered.

-

- Plan your investment for the future. Many people buy a luxury home to enjoy a better quality of day-to-day life, but this is also an investment for the future. Think about the quality of this neighborhood and how it might evolve in the future. Think about the trajectory of home prices in the area. And think about how long you might realistically stay in this home.

-

- Watch out for extra costs. Be aware of extra costs that may come with your home purchase, and budget accordingly. For example, you may be responsible for closing costs, or some maintenance and initial repairs when you move in.

Learning From Experience

If you’ve bought a home in the past, even if it wasn’t a luxury home, you can use your past experience to guide this decision. Think carefully about the mistakes you made, the good decisions that helped you succeed, and the people who added to the value of your experience. It’s also a good idea to keep your home buying documents organized this time around, so the next time you want to buy a luxury home, you’ll be in an even better position.