Three archetypes with a major impact on the luxury real estate landscape in 2020-2021.

Coldwell Banker Real Estate gathered the most current wealth research generated by WealthEngine, Wealth-X, and other third-party sources and combined it with anecdotal evidence from Coldwell Banker Global Luxury Property Specialists in the field to identify three archetypes that are having a major impact on the luxury real estate landscape in 2020.

With priorities shifting towards family, friends, health and wellness, combined with other factors such as teleworking, this year’s “New Affluent Trailblazers” report by Coldwell Banker Real Estate LLC and the Coldwell Banker Global Luxury program highlights the luxury home buying preferences of a new set of affluent demographics migrating their wealth to new, unexpected markets.

A main takeaway from the report is the decentralization of wealth as buyers have put down roots in suburban pockets across the country. The pandemic has changed habits, including those of luxury homeowners, and the longer it continues, these new behaviors and lifestyle choices may become more permanent, reinforcing the Trailblazer preferences and mentality.

Driven by unparalleled change and uncertainty in 2020, Trailblazers are defying traditional migration patterns and demographic factors such as net worth, age, and gender. These potential home buyers are turning their attention away from cities and opting to move to new locations that better accommodate their family needs, placing emphasis on health and safety, privacy, access to more space, and intangible luxury items such as on-demand healthcare and additional passports.

Explorers:

Ready to leave the city behind for a new adventure, explorers are looking for homes in America’s exurbs and “hidden gem” towns where their dollar will carry them further. They are less concerned with status and more willing to choose locations in slightly more rural, non-traditional luxury markets — if it means that they can have better schools, access to open space and a dynamic mix of shops, restaurants and recreational facilities that allow them to center a lifestyle focused on family. Explorers tend to be younger (under the age of 39), married with at least one young child, and have a net worth in the $1 to 5 million range. Many are business owners, or business executives or work in professions that allow them the flexibility to work from home, making it easier for them to live farther away from major metro centers.

Explorers: Fredericksburg, Texas; Truckee, California; Rock Hill, South Carolina.

photo @westfieldnj.gov

New Suburbanites:

New suburbanites prefer suburbs that offer personal space, private backyards, a bedroom for each child, plenty of property amenities (like dual home offices for two working parents), good schools and, in some cases, a dose of city culture with newly developed urban-style mixed-use centers with restaurants, retail, offices and open green spaces. Despite the fact that many new suburbanites are entrepreneurs, business owners or senior managers who have the ability to work from home, they may still need to be within commuting distance of cities for work or business. The majority tend to be slightly older than explorers (between the ages of 39 and 54) and are married with two or more school-aged children. While net worth and disposable income vary based on location, they also tend to have a higher net worth ($5 to $10 million). Many own more than one home.

New Suburbanites: Winnetka, Illinois; Westfield, New Jersey; Brentwood, Tennessee.

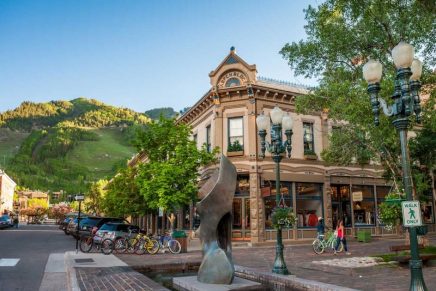

Resorters:

Drawn to world-class vacation destinations, resorters are heading to locations where they can enjoy a resort lifestyle, complete with fresh air, freedom and access to recreation and luxury amenities. They may either be permanently relocating to their favorite vacation spot or converting a second home to a primary residence in response to the pandemic. Resorters are often in a higher wealth bracket of $10 million and over. The majority is slightly older (over

the age of 54) and married with possibly older or adult children, and they often own at least two properties, including a home in a city. The majority are established business owners with middle management onsite, giving them the freedom to work remotely and may also be at retirement age, giving them extra freedom to live anywhere they want.

To identify the top nine luxury real estate markets on the rise among Trailblazers, the Coldwell Banker Global Luxury program and the Institute for Luxury Home Marketing began with 24 markets that fall into the category of hidden gems, suburbs and vacation destinations and then used the “Affluent Relocation Index” to score these markets based on 12 key drivers of affluent relocation for 2020. To obtain an Affluent Relocation Score, each of these key indicators (qualities like Safety and Security; Cost of Living; and Schools) was given a ranking between 1 and 12, based on analysis from local experts in the Coldwell Banker network.

Resorters: Aspen, Colorado; Boca Raton, Florida; The Hamptons, New York.