The desire to travel is strong, and consumer and commercial demand for air travel, measured by flight bookings, accelerated meaningfully in early 2022. Could this be the start of travel’s long-awaited recovery?

- Cruises, buses and trains see strong spending rebound in 2022 as Covid restrictions loosen.

- Mastercard Economics Institute: Pent-up demand drives global leisure and business flight bookings past 2019 levels.

- U.S., U.K, Switzerland, Spain and Netherlands top the list of most visited destinations

After a turbulent two years, new research from the Mastercard Economics Institute reveals that global leisure and business flight bookings have surpassed pre-pandemic levels, while spending on cruise lines, buses and trains saw sharp improvements this year. Released last week, Travel 2022: Trends and Transitions delivers critical insights across 37 markets about the global state of travel in a post-vaccine and less restricted chapter of the pandemic era.

Importantly, according to the Mastercard Economics Institute analysis, if flight booking trends continue at the current pace, an estimated 1.5 billion more passengers globally will fly in 2022 compared to last year. Drawing on a unique analysis of publicly available travel data, as well as aggregated and anonymized sales activity in the Mastercard network, the report dives into key elements of the traveler journey. Key findings through April 2022 include:

Leisure and business flights surpass pre-pandemic levels.

Travel recovery has been a largely consumer story for much of the pandemic. By the end of April, global leisure flight bookings surpassed 2019 levels by 25%; short- and medium-haul leisure flight bookings were up 25% and 27%, respectively. Global business flight bookings exceeded pre-pandemic levels for the first time in March, with long-haul specifically growing double-digits in April. The return to office was an important driver.

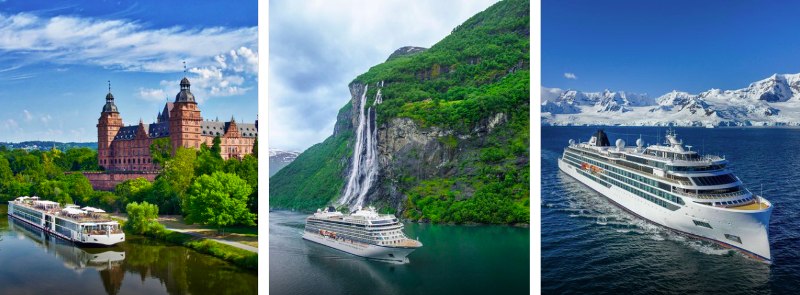

Hard-hit transportation industries see spending rebound: Recent spending levels point to greater comfort with group travel. Global spending on cruises gained 62 percentage points from January to the end of April, though remains below 2019 levels. Buses are back at pre-pandemic levels, while passenger rail spend remains 7% below. Meanwhile, car road trips maintain their appeal, with spending on tolls and auto rentals up nearly 19% and 12%, respectively.

Travel spending shifts back to experiences over things:

For the better part of a year, international tourists spent more on experiences instead of souvenirs when in destination. Experiential spending is now 34% above 2019 levels; the areas seeing the largest spending increases are bars and nightclubs (72%) and amusement parks, museums, concerts and other recreational activities (35%). International tourist spending on experiences in destination grew 60% in Singapore and roughly 23% in the U.S. In the U.K., spending growth each month in 2022 more than doubled compared to 2019 levels, currently 140% for April.

Loosening of restrictions recalibrates tourism map for 2022.

Not surprisingly, the ability and convenience of travel has been a driving factor in booking destinations, though 2022 has provided a clean slate with restrictions loosened in much of the world, aside from parts of Asia-Pacific. The result is that the U.S., U.K, Switzerland, Spain and The Netherlands are now the top destinations for tourists globally.

“Like any flight, the travel recovery has faced both headwinds and tailwinds. As the ‘Great Rebalancing’ takes place around the world, this mobility is critical to a return to pre-pandemic life,” said Bricklin Dwyer, Mastercard chief economist and head of the Mastercard Economics Institute. “The resilience of the consumer to return to ‘normal’ and make up for lost time gives us optimism that the recovery will continue directionally, even if there are bumps along the way.”

You can view the full Travel 2022: Trends and Transitions report here.