Staying on top of your financial situation can be difficult. No matter how committed you are to making your budget-friendly New Year’s resolutions, bills pile up and life happens. Whether you’re looking to pull yourself out of burdensome debts or would like to magnify the scale of your savings account, getting into the best financial shape of your life is far simpler than you may think.

Read on for our list of top ways to get into better financial shape by the end of the year.

Method #1: Set up a working budget

Our easy recipe for planning out a budget is to calculate your incoming cash flow, subtract your regular outgoing costs (bills, groceries, gas), and budget the remaining amount. With a constant understanding of how much money you have to spend, you’ll know what you can (and cannot) reasonably afford.

Method #2: Tackle tax season early

Rather than waiting until early April to ask yourself “Do I owe the IRS back taxes?” take care of your civic tax duties ahead of schedule. The IRS is nothing to mess with, especially if you end up with a hefty tax bill. Don’t wait until the last minute to tackle tax season.

@Montblanc

Method #3: Open a savings account

One of the best ways to motivate yourself to save money is by opening a savings account. Choosing a bank with a generous APY rate will further incentivize you to build your savings. Nothing feels better than watching your account grow without you having to lift a finger!

Method #4: Skip the plastic

Studies have shown that people find it much easier to swipe a card than it is to hand over cash. If you find yourself making regular impulse buys, leave your credit card at home when you’re out with friends or headed to the shops. Working with a limited amount of money rather than an imaginary unlimited supply will help limit your spending habits.

Method #5: Nip unnecessary bills in the bud

If you depend on Netflix and Hulu for all of your TV and movie-watching needs, there’s no need to maintain your cable subscription. Cutting down on pricey bills will help you keep more money in your pockets. According to cable compare, 59 percent of young Americans have already cut the cord and there will be more than 55 million cord cutters by 2022. For more cord cutting statistics, please visit cablecompare.com.

Method #6: Pick up a side-hustle

If your full-time hustle isn’t cutting it, and you’re nowhere near the possibility of a raise, looking into a lucrative side hustle may be your calling. Freelance writing, fashion blogging, travel photography, ridesharing, and pet care are all popular side hustles that anyone can get into with the right tools and mindset.

Method #8: Take advantage of employer benefits

The face of the modern company is fast changing. The vast majority of employers offer several benefits like medical insurance, free meals, stock options, life insurance, and retirement plans. These perks ease a number of financial burdens if you take advantage of them.

Method #9: Put your bills on auto-pay

The only thing worse than paying bills is the array of late fees that arise when you miss a due date. Automate payments by signing up for auto-pay where you can. No more relying on memory to keep your bills paid, and no more worrying about frustrating late fees!

Method #10: Stop overspending

Overspending is easy. Impulse buys speak louder than reason sometimes, but it’s important to be able to separate the necessary from the unnecessary. From the grocery store to travel bookings, if there’s a cheaper option that maintains convenience and quality, there’s no need for a superfluous upgrade.

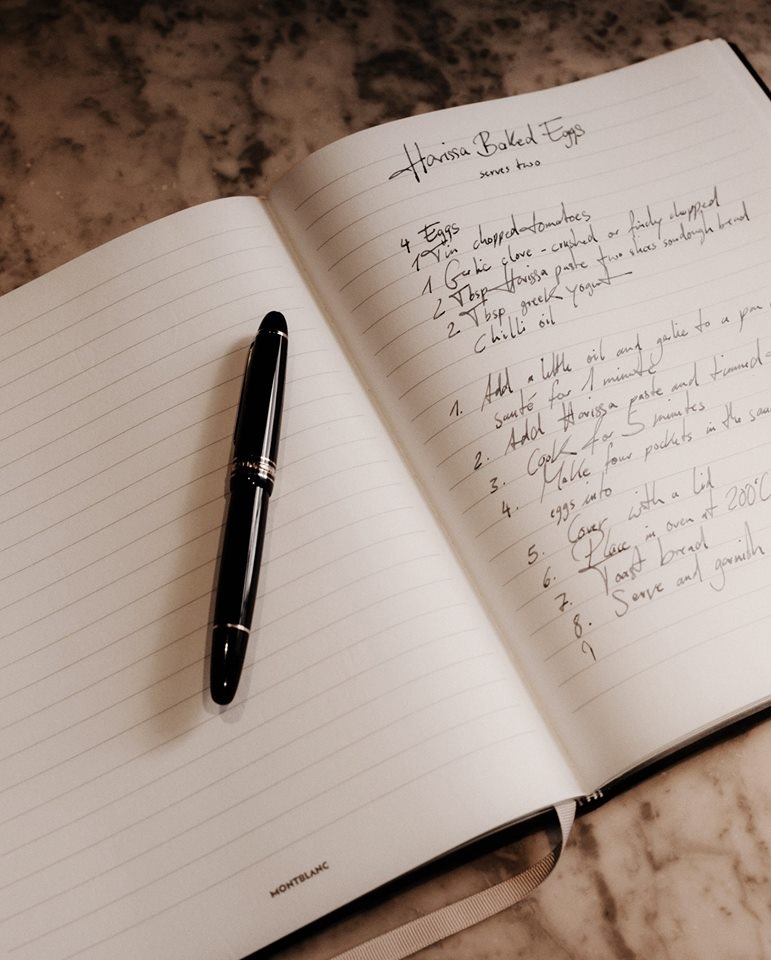

@Montblanc

Method #11: Eat at home

Eating out every night of the week would build up a nasty monthly bill if you took the time to do the math. If you’re looking to cut down on frivolous costs, start with your stomach. Your kitchen is fully equipped with the tools needed to create those delicious meals you dish out for—why not learn how to cook them yourself?

With these tried and true tricks, you’ll be on your pathway to financial success within a 365-day span. Always remember that consistency is key. Regardless of what your monetary goals are, making a goal is only one half of the job—sticking to it is the hard part.