Value of Britain’s 150 biggest brands has fallen by £30 billion in last year, as economic effects of COVID-19 ravage key brands and sectors.

The total value of the United Kingdom’s top 150 brands has declined by over £30 billion or 8% of the total over the first year of the COVID-19 pandemic, from £356.8 billion in 2020 to £326.7 billion in 2021, according to the Brand Finance UK 150 2021 report. Notable brand value casualties include aero-engine maker Rolls Royce (-45%), British Airways (-43%), housebuilder Taylor Wimpey (-32%), EasyJet (-29%), Burberry (-26%), and Premier Inn (-24%)

With international and even domestic travel banned or severely restricted, airlines and hotels are among the worst affected sectors, with total brand values for the sector falling by 38% and 22%, respectively.

British Airways is the fastest-falling airline brand, down 43%. Similarly, aero-engine maker Rolls Royce is down 45%.

Other COVID-hit sectors have also seen significant brand value declines. Housebuilders were severely disrupted in

2020 due to initial confusion over whether they were essential workplaces, disruption to supply chains, and difficulty operating under COVID-safe conditions, contributing to a brand value decline of 32% for Taylor Wimpey.

Burberry, one of Britain’s strongest and most iconic brands, has also seen its brand value fall, losing 26% over the past year. Retail locations have been closed, high-spending international customers have been unable to visit key stores and concessions, and perhaps most fundamentally, the lack of opportunity to wear and display the Burberry brand in public has diminished its potency.

“Some of the brand value changes this year will be the temporary results of a unique operating environment for brands, but others will be longer lasting. For example, the decline of airline brand values is not simply the result of temporary restrictions in the airlines’ ability to monetise their brands. British Airways and EasyJet have seen both their brand values and also their brand strength scores decline, indicating more fundamental damage to brand assets. Some customers were disappointed and frustrated with the airlines’ refund policies, while many more, particularly business travellers, are reassessing their relationship with airlines in the light of climate concerns and recently enhanced comfort with teleconferencing.” – Richard Haigh, Managing Director, Brand Finance.

Home delivery brands deliver

Deliveroo may be facing a torrid time in the capital markets, but the pandemic has undoubtedly bolstered its brand with consumers as it recorded a 52% brand value rise to £2.2 billion. Deliveroo has benefited from the displacement of hospitality spend, where consumer demand for quality food and small indulgences cannot be fulfilled by lockdown-hit restaurants and bars, with consumers turning to takeaways. However, it would not have enjoyed such striking success without consistently strong marketing communications and delivery against customer expectations. As a result, though it is likely there will be a slight correction in brand value as hospitality re-opens, Deliveroo has created a foundation for longer term growth, allowing it to capitalise on lasting behavioural change and opportunities for geographic expansion.

ASOS and Ocado, pioneering home delivery brands in fashion and grocery respectively, have also performed well as

a result of the pandemic. ASOS is up 38% to £1.1 billion and Ocado 28% to £600 million.

Health and hygiene brands have also performed strongly.

Home-cleaning brands Finish, Dettol, Airwick, and Lysol have all increased in value by around 20%, while brands focused on personal health have also seen significant increases, including The Body Shop (up 21% to £557 million) and Boots (up 18% to £2.4 billion).

AstraZeneca, instrumental in pulling the country out of the COVID crisis, has also seen significant brand value gains of 17% to £2.4 billion. Given that governments have purchased billions of doses of its COVID vaccine and the business has received widespread praise from British politicians and clinicians, the increase in brand value might have been higher.

“AstraZeneca chose to manufacture its vaccine at cost and the forgone revenue makes this a costly decision in terms of short-term brand value growth. However, the goodwill generated amongst the medical community, governments, and patients make it a very shrewd one in the long term, generating preference for the brand by end users and supporting the company’s ‘license to operate’ – smoothing relationships at a governmental, societal, and business-to-business level.” – Richard Haigh, Managing Director, Brand Finance.

However, there is also a less positive explanation for the limited brand value rise. Aspersions have been cast over the safety and effectiveness of the AstraZeneca vaccine. Whilst some of these concerns are unfounded or exaggerated for political reasons, evidence of an enhanced risk of blood clotting has been enough for several European governments to restrict or ban its use. The result is a brand with significant variation in perceptions by geography.

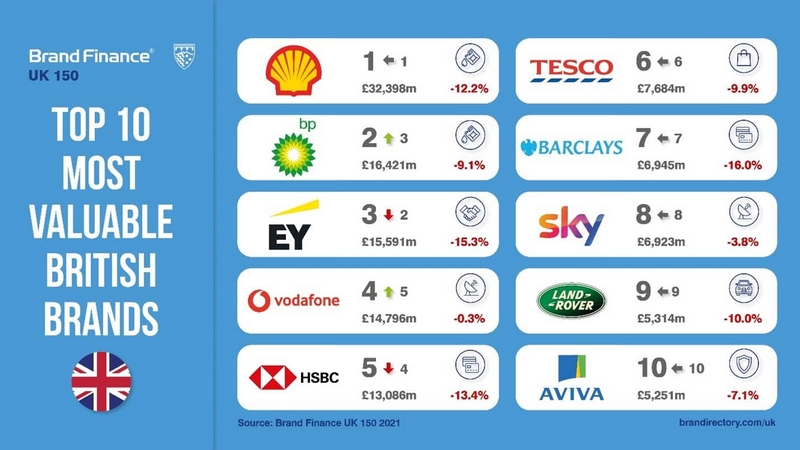

Shell retains top spot

Shell remains the UK’s most valuable brand and the world’s most valuable oil and gas brand, with a brand value of

£32.4 billion. Despite a 12% brand value decline, Shell continues to lead the list comfortably, with a brand value nearly double that of second-placed BP (down 9% to £16.4 billion).

EY – the UK’s strongest brand

In addition to measuring overall brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance.

According to these criteria, EY remains the UK’s strongest brand with a Brand Strength Index (BSI) score of 89.6 out of 100 and the elite AAA+ brand strength rating as the only brand in Britain. This top place ranking validates the brand’s focus on long-term value creation for stakeholders, which has been particularly important when navigating the pandemic.