Global Prime Property Prices Surged in 2021 Amid Soaring Asset Prices.

Forbes Global Properties’ 2021 Year-End Market Perspective report – New Report on the International Luxury Real Estate Market; @.forbesglobalproperties.com/annual-report/

The state of the prime property market. Report.

Even if luxury homes were purchased initially as a vacation residence, HNWIs are increasingly using these homes for primary home purposes and for longer periods of time. These are the finding of Forbes Global Properties’ 2021 Year-End Market Perspective report. Coinciding with the organization’s first anniversary, the Year-End Market Perspective draws from the transactions and expertise of more than 2,400 leading experts across 11 countries.

A comprehensive analysis of the international luxury property market gleaned directly from its local leading experts, the report examines global property prices, buyer demographics, desired luxury amenities, and second home market trends, while also underscoring market enthusiasm through anecdotal recounts of recent transactions.

The population of potential luxury home buyers grew substantially in 2020-2021, as did the net worth of the world’s wealthiest individuals. Forbes estimates that between March 2020 and March 2021, nearly 500 individuals joined the billionaire class, with roughly one new billionaire minted every 17 hours during the early pandemic. The global group of high-net-worth-individuals (HNWIs)—those with investable assets of more than US $1 million excluding their primary residence—also increased, growing by 1.2 million over the past year according to Capgemini’s 2021 World Wealth Report.

As the pool of potential luxury home buyers expanded, so too did the motivation of HNWIs to buy a new prime property. This amplified interest in luxury property acquisition, coupled with a growing population of HNWIs worldwide, provided ideal market conditions for our first 12 months in operation.

“To celebrate our first anniversary, we invited our member brokerages spanning 11 countries and 140 locations—all established local leaders in luxury property sales— to share their successes and perspectives on the state of the prime property market. ” – said Jeff Hyland President and Co-Founder, Forbes Global Properties and Bonnie Stone Sellers, Chair and Co-Founder Forbes Global Properties.

Forbes Global Properties‘ Report highlights include:

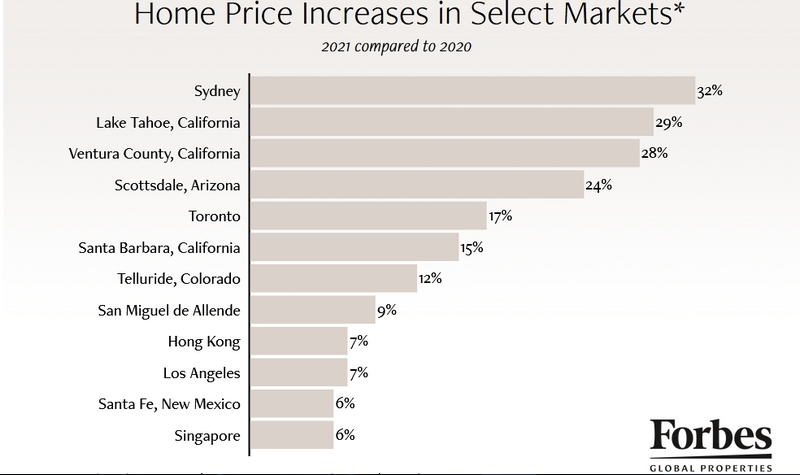

2021 median prices considerably outpaced 2020 price increases, with domestic markets like Lake Tahoe, Ventura County, and Scottsdale reporting double digit gains of 29%, 28%, and 24% respectively.

Hawaii exemplified exponential growth as luxury sales priced at US$3 million and above in 2021 surged past 2020 with a 195% increase in transactions and 235% increase in total dollar value sold.

International markets followed similar upward pricing trends as evidenced by increases of 32% in Sydney, Australia, and a 17% increase in Toronto’s average price.

Individuals under the age of 56 (Gen X, Millennials, and Gen Z) comprised at least two-thirds of buyers in many of the luxury primary home markets studied, with Gen X accounting for the largest demographic in selected markets as evidenced by a 70% share in Lake Tahoe and 50% in Hong Kong.

Several of the primary home markets surveyed reported a demographic shift with Millennial buyers (ages 25-40) representing a growing proportion of overall luxury buyers.

Luxury buyers expressed 68% preference to more indoor and outdoor space, 64% prioritized a home office, followed by 32% seeking privacy, and 19% gravitating towards a move-in ready home.