How investors are creating value by helping forests, wetlands, and grasslands flourish.

Natural climate solutions (NCS) include forests, grasslands, and wetlands that can either sequester carbon or, through preservation, prevent its release. NCS also represent a new source of potential growth for investors, say Bain & Company experts.

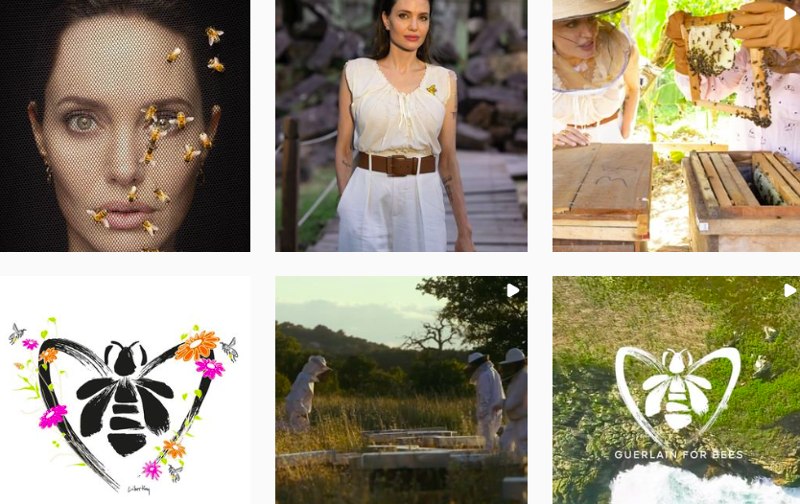

Natural climate solutions (NCS) will play an important role in the energy transition, but until recently, they have received less attention and capital than other solutions. Now, NCS are emerging as a new asset class, spurred along by the growth of carbon markets, progress toward shared standards, a flourishing ecosystem of players, and technological innovation. Guerlain, Rolls-Royce, LVMH, Kering luxury group, Yves Saint Laurent, and Dior are some of the luxury brands investing actively in NCS.

Private capital is moving into NCS.

Given their potential to abate greenhouse gas emissions, their comparatively low marginal costs, and their ability to deliver other benefits, NCS are expected to be a key component of any pathway that limits global warming to well below 2 degrees Celsius above preindustrial levels, in line with the Paris Agreement. NCS could account for 37% of total mitigation efforts—about 11 gigatons of carbon dioxide out of the net 30 gigatons that need to be abated each year—while also delivering economic and social benefits, such as restoring ecosystems and securing the transition to low-carbon livelihoods for communities that depend on natural resources.

NCS also represent a new source of potential growth for investors.

Today, only about 2% of the $632 billion deployed globally each year in climate capital goes toward natural solutions. The main reasons are that investors are unfamiliar with this asset class and unsure about the returns given the volatility of carbon prices. Bain & Company expects that to change over the next few years, and it seems likely that the entry of institutional investors will help mature this asset class and bring it into the mainstream.

“Investment funds are growing rapidly, and private investors are showing more confidence in this asset class. Over the past five years, more than 50 new funds with a strong focus on NCS have been launched, about 20% more than in the previous five-year period. Of the $45 billion to $50 billion in committed capital from these funds, a third or more comes from private investors. These investments are increasingly viable, no longer dependent on public grants or a spirit of philanthropy.” – Bain & Company.

The American management consulting company headquartered in Boston, Massachusetts identified three types of NCS funds that are emerging with different sources for returns and target investors.

- Sustainable product funds focus on greening supply chains for those with net-zero and sustainable sourcing commitments.

- Nature+ funds invest directly in NCS to provide financial and nonfinancial returns for long-term investors.

- Carbon pure play funds secure carbon credits from NCS investments within a broader carbon sequestration portfolio.

While the market for carbon credits and natural climate solutions develops, investors need to consider five important aspects of the current opportunities in credits—namely, a tight inventory of NCS projects and long development times, a low correlation between price and quality, no consensus on how to measure and price cobenefits, an evolving trade infrastructure in the nascent voluntary carbon markets, and the political and regulatory risks in a largely unregulated, fragmented carbon market.