The Affluent Pause: Why America’s High Earners Are Trading First-Class for Fiscal Prudence This Holiday Season. @VistaJet

The Affluent Paradox: Luxury Travel‘s New Landscape of Frugality and Focus

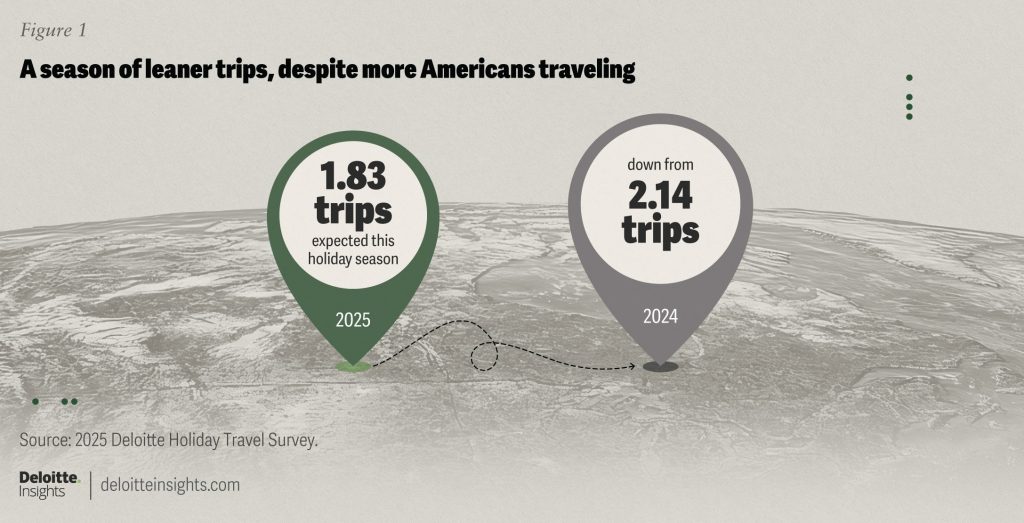

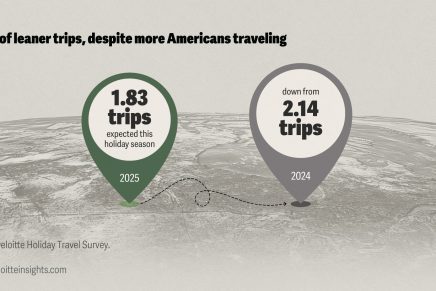

The latest Deloitte 2025 Holiday Travel Survey presents a fascinating, almost paradoxical, snapshot of the premium travel market: a consumer base that is more intent on traveling than in recent years, yet is simultaneously demonstrating acute financial caution, particularly among the highest-spending segment. For the luxury industry, this data signals a pivot from blanket indulgence to highly targeted, value-justified exclusivity.

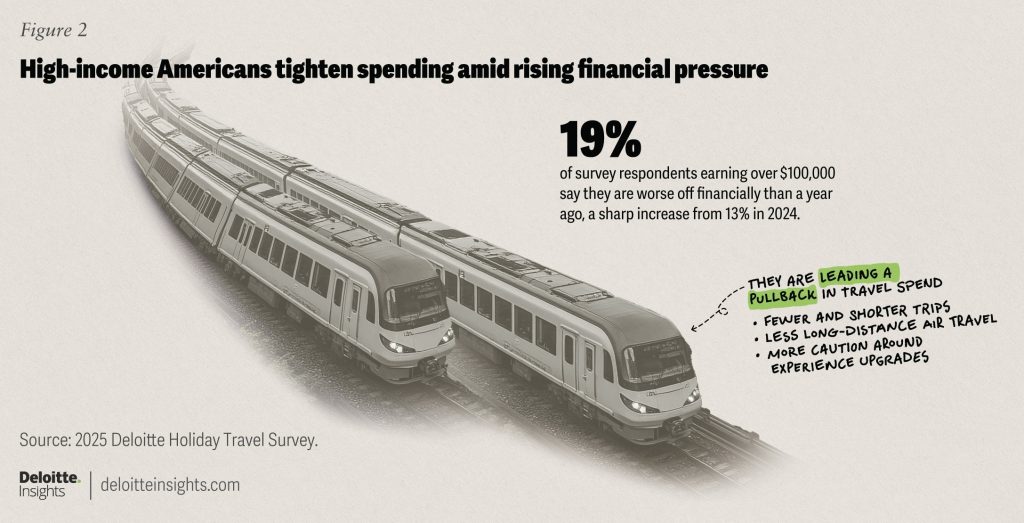

The High-Income Traveler: A “Cautious Class” Emerges, says Deloitte 2025 Holiday Travel Survey

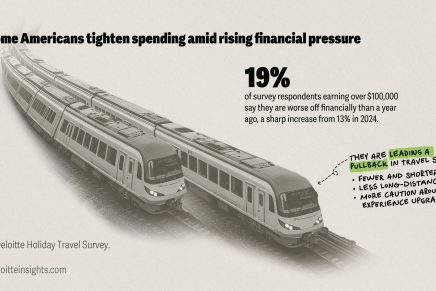

The most disruptive finding is the emerging “cautious class” among high-income Americans (those earning $100,000 or more annually). While typically the bedrock of premium spending, this group is leading the reduction in travel metrics. Financial sentiment is driving the change: 19% of high earners report feeling worse off financially than a year ago, a sharp rise from 13% in 2024. This sentiment is translating directly into behavior:

High earners plan to cut their average number of trips from 2.5 to 1.9.

Among high-income travelers who feel financially worse off, 37% plan to cut in-destination spend and 35% plan to opt for less luxurious lodging.

Overall, the average planned holiday travel budget across all consumers is down a significant 18% year-over-year to $2,334.

This trend is not about poverty, but about prudence. The ultra-high-net-worth customer remains active, but their spending is becoming more selective, impacting revenue-per-available-room (RevPAR) and airline load factors in premium cabins. Luxury providers must now work harder to justify the marginal cost of an upgrade or an extended stay with demonstrable, non-negotiable value—a clear connection to the investment in performance seen in the VistaJet Sleep Program, rather than mere ostentation.

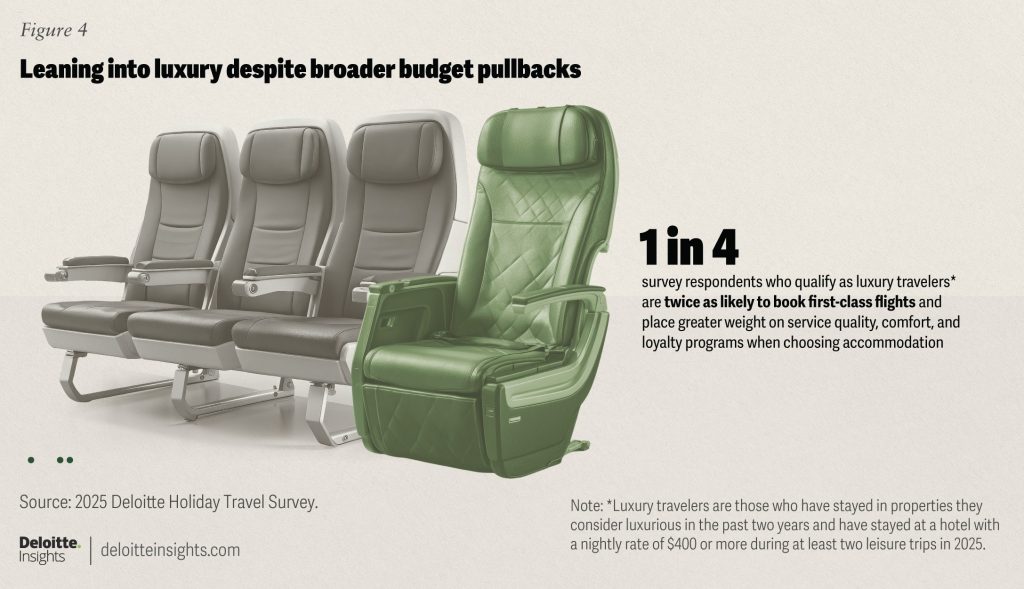

The Enduring Pockets of Luxury Demand

Despite the broad pull-back, a critical segment remains loyal to high-end experiences. One in four surveyed travelers meet Deloitte’s criteria for “luxury travelers.” This group is defined by their recent history of staying at luxurious properties and hotels costing $400 or more per night on at least two leisure trips in 2025. Their preferences are instructive:

They are twice as likely to book first-class air tickets.

They place greater weight on customer service and loyalty memberships when selecting hotels.

For luxury hoteliers and airlines, this group represents the crucial lift in a softer market. Winning their engagement requires balancing programmatic loyalty (e.g., maximizing elite status benefits) with delivering on high expectations of customer experience and personalization. The core takeaway is that quality of service and the value of membership are now the non-negotiable drivers of premium selection, not simply the availability of a high price point.

The Generational Shift: Digital Fluency and Nuanced Luxury

A fundamental generational inflection point is redefining the luxury traveler profile. For the first time, Gen Z and Millennials are expected to make up half of the US holiday traveling public. Millennials, specifically, remain the highest-spending generation with an average planned holiday travel budget of $2,602. Their influence extends beyond volume into how travel is consumed:

Millennials are leading the adoption of generative AI for trip planning, with Gen AI usage surging 1.5x since 2024.

Over half of Gen Z respondents use short-form social video for travel inspiration and research.

This trend highlights a market that is not only younger but intensely digitally fluent. Luxury brands must pivot their marketing from traditional channels to authentic, short-form digital narratives. Furthermore, the definition of luxury is becoming more nuanced across these younger segments: while Boomers value location, Gen Z links luxury to the availability and quality of amenities, and Millennials (who often travel with children) associate it with on-property dining. Suppliers must tailor their value proposition not just by income, but by generational preference, making the luxury experience personalized to the traveler’s stage of life and definition of “splurge.”

The Deloitte findings underline the urgent need for the luxury travel sector to evolve its strategy from mass-market affluence to curated, data-driven personalization. Would you like to explore how technology—specifically Generative AI and short-form video—is changing the marketing playbook for luxury resorts looking to capture the Millennial and Gen Z traveler?