Digital benchmarking firm L2 released its 9th annual Digital IQ Index: Watches & Jewelry 2018.

The L2 report benchmarks the digital performance of 70 Watches & Jewelry brands. The report provides insight into the digital strategies of gray market and reseller sites as well as best practices for brands to enhance their digital investments in order to reach the growing cohort of Millennial luxury consumers. The Digital IQ Index methodology examines a brand’s strengths and weaknesses across the four digital dimensions of Site and E-Commerce, Digital Marketing, Social, and Mobile. Index brands are classified as either Genius, Gifted, Average, Challenged, or Feeble.

The report features case studies on brands including but not limited to: Cartier, Mr Porter, Pandora, Ritani, and Tiffany & Co.

“2017 marked a return to growth for the Watches and Jewelry sector,” noted Brian Lee, Associate Director at L2. “Primarily driven by recovering sales to Chinese consumers, both in China and abroad, winning brands are those who invest in strategies to reach new demographics and younger consumers on social media and who are investing in new distribution channels.”

Key findings from L2’s “Digital IQ Index: Watches & Jewelry 2018” report include:

Increasing E-Commerce Adoption:

Five watch brands launched direct-to-consumer e-commerce in the past year. Sixty-two percent of Index brands now supports DTC e-commerce, up from 53 percent in 2017. However, DTC remains primarily the mark of affordable and aspirational brands, 90 percent of who offer DTC e-commerce compared to just 35 percent of luxury brands.

Losing Visibility to Discounter Sites:

Search remains a weakness for Index brands. Sixty-four percent of Google search results for Rolex go to resale sites, while 42 percent of search results for Omega take consumers to gray market pages. Even more drastic, 85 percent of Google search results for Roger Dubuis are for resale sites,13 percent go to gray markets, leaving just 2 percent of results that link back to official retailers.

Instant Touchpoints:

Index brands are increasingly improving response times on Facebook Messenger as 33 percent now reply within minutes. Fifty-nine percent have also introduced menus with guided questions to preempt frequent inquiries. Jaeger-Lecoultre takes it one step further, integrating Messenger in the primary navigation on both their desktop and mobile site.

“Watches & Jewelry brands have been hesitant to invest in digital initiatives,” explained Reid Sherard, Associate Director at L2. “However, long standing digital holdouts like Vacheron Constantin and Buccellati have recently become part of the vanguard by investing in digitally native growth channels like Hodinkee and Net-a-Porter over department stores or existing independent retailers.”

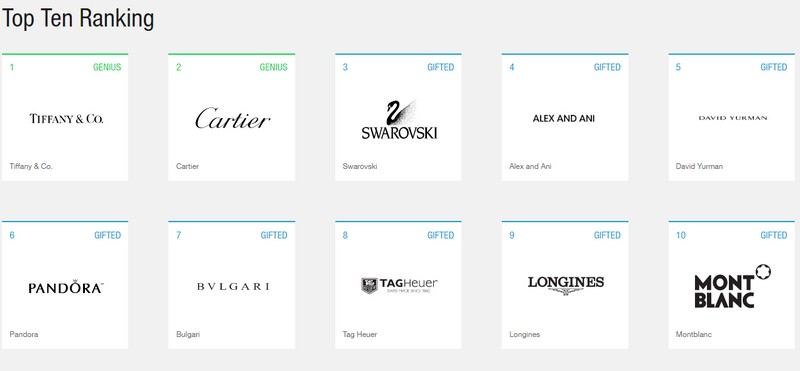

Top Ten Ranking Digital IQ Index: Watches & Jewelry 2018:

1. Tiffany & Co. – GENIUS;

2. Cartier – GENIUS;

3. Swarovski – GIFTED;

4. Alex and Ani – GIFTED;

5. David Yurman – GIFTED;

6. Pandora – GIFTED;

7. Bulgari – GIFTED;

8. Tag Heuer – GIFTED;

9. Longines – GIFTED;

10. Montblanc – GIFTED.