Luxury seeks to balance the exclusive and inclusive.

Louis Vuitton, Hermes and Gucci are the top 3 global luxury brands of 2013, according to 2013 BrandZ Top 100. Luxury brands became more accessible, collaborative and experiential, says MillwardBrown annual research. On Facebook, Instagram, Pinterest and other social media platforms, brands across the luxury spectrum mediated the tension between the exclusivity that protects brand desirability and the inclusivity needed to attract new customers.

They personalized brand experience in ways that went beyond segmentation to focus intimately on the individual customer. Someone buying an affordable accessory might receive a thank you on Twitter, for example, while an invitation to an exclusive fashion show might be sent to a couture customer.

Authenticity was key. Long-established brands emphasized heritage. Newer arrivals developed compelling and authentic brand stories. The category overall experienced a new normality, however, as customers continued to spend on luxury, but carefully.

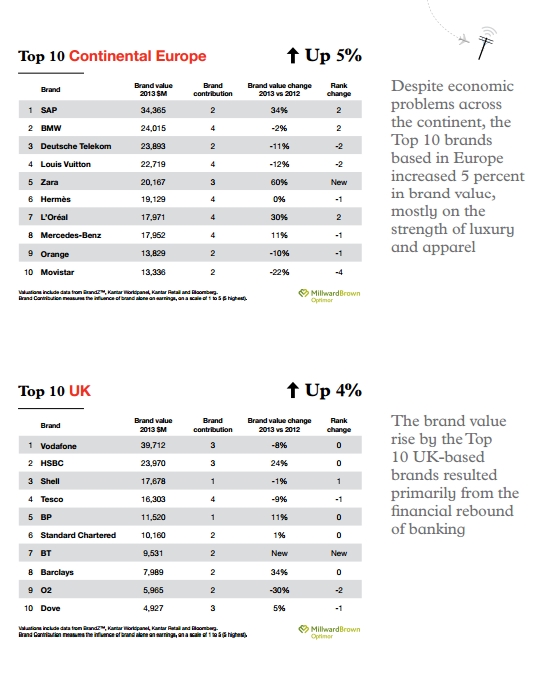

The US economic rebound helped. Still, the brand value of the luxury category overall rose 6 percent, compared with a 15 percent increase a year ago. These other trends and developments also influenced the category:

China

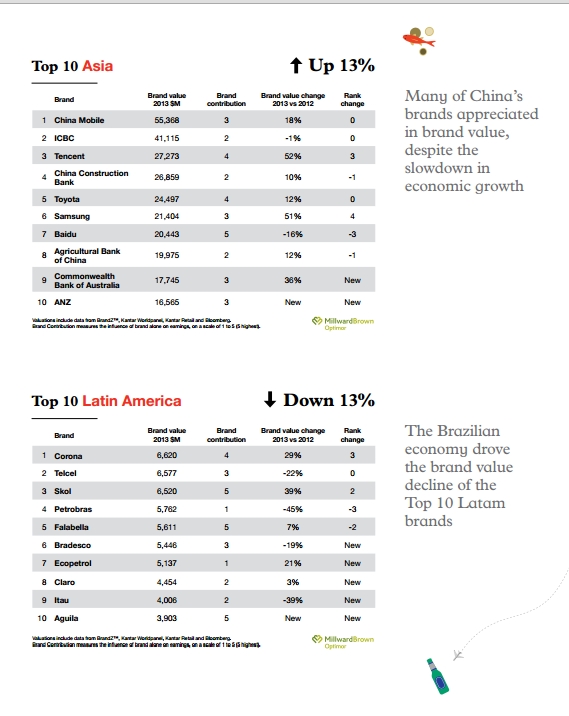

In China, luxury brands felt the impact of slowing economic growth, more discerning customers and government limits on official gift giving.

Europe

Purchases by Asian tourists buoyed luxury sales in the economically troubled markets of Western Europe.

US

Relaxed US visa requirements for Chinese and Brazilian visitors were expected to boost future luxury sales.

This challenging economic environment produced mixed results. The Prada brand experienced strong sales and profits across all regions, even in the difficult economies of Western Europe where new stores and Asian tourist traffic drove activity. Prada’s brand sales increased 33 percent. With a 63 percent increase in brand value, Prada led all categories in brand value appreciation and entered the BrandZ Top 100 Most Valuable Global Brands for the first time.

Top 10 luxury brands in 2013:

1. Louis Vuitton

2. Hermes

3. Gucci

4. Prada

5. Rolex

6. Chanel

7. Cartier

8. Burberry

9. Fendi

10. Coach.

Coach entered the BrandZ ranking of luxury brands for the first time in partdue to strength in China, where the brand added 30 stores, ending 2012 with 69 Chinese stores. Coach faced heated competition in the US. It refined its use of social media and the Internet, emailing over 1.2 billion messages to selected customers.

Fendi also appeared for the first time in the ranking of luxury brands. The brand value of Gucci grew by a healthy 48 percent. Although sales softened in Asia, they remained strong in North America and even in Western Europe because of tourists from Asia and other regions. The brand value increase also reflects a rise in Brand Contribution, the portion of brand value attributed solely to brand and not to financial or other factors.

Already available online in 27 countries, Gucci announced its first mobile app, increasing the brand’s accessibility. Accessibility may have hurt the highest valued luxury brand, Louis Vuitton, whose customer appeal depends on exclusivity.

Hermès benefitted from its exclusivity and appeal to the high-end of the luxury market. Profit increased 24.6 percent on a sales increase of 22.6 percent. Its profit margin improved too.

With consumers enthusiastic about luxury, but mindful about spending, many brands acted like media owners, organizing

audiences around shared interests and creating content to suit particular audience segments and even individuals. Magazines and other traditional media remained important for reinforcing brand image. But brands developed anddistributed more story-telling content themselves.

Burberry relied on new stories and the latest technology to create a more personalized, twenty-first century image

for a brand established in 1856.

In a program called Smart Personalization, Burberry embedded digital chips in some of its custom-made merchandise. When customers received their bespoke products they could activate the chip using a smartphone and view a video of their product being crafted and personalized with their name.

The brand also planned to introduce a program called Customer 360 that would empower salespeople with tablet devices containing customer preference and shopping history information. Burberry’s brand value continued to appreciate, but at a lower pace as the global economy impacted like-for-like sales. Asia accounts for about 40 percent of the brand’s revenue.

At the same time, other brands appeared at the margins of the luxury category. Lacking heritage, and not yet of a scale to make the BrandZ™ ranking, these brands depended on compelling stories passionately communicated. Among the brands, mostly aimed at young people are: Sweden’s Acne (Ambition to Create Novel Expressions); Bree, from Germany, and the American apparel brand Tory Burch.

Local luxury brands also appeared in China as the consumer attitude toward luxury evolved from an obsession with badge status to an appreciation of craft. These brands include qeelin, a collection of fine jewelry based on Chinese heritage and sold in Paris,London and other world capitals.

The three fastest growing brands— Prada, Brahma, and Zara—came from diverse consumer categories: luxury, beer and apparel. Prada increased 63 percent, driven by the ongoing appetite for luxury, particularly in fast growing markets.

The 61 percent brand value rise of Brahma, a Brazilian beer owned by AB InBev, the world’s largest brewer, demonstrated the power of a global marketer and the continued vitality in the BRICs.

The fast fashion apparel brand Zara grew 60 percent in brand value, indicating that value still drove shoppers, even though consumer confidence remained fragile.

Eight newcomers, from five categories— luxury, retail, banks (global and regional), technology, and telecom providers entered the BrandZ Top 100: the Italian luxury brands Gucci and Prada; from Australia, the regional banks ANZ and Westpac, plus the supermarket Woolworths; and JP Morgan, a global bank. In addition, the technology brand Yahoo! and BT, the telecoms provider, entered the Top 100.