Trends shaping the luxury real estate market globally. Christie’s International Real Estate report.

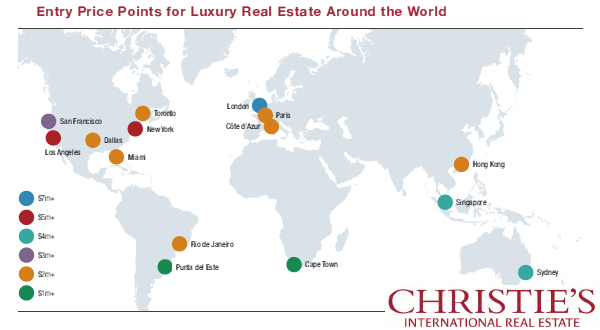

With more millionaires and billionaires in the world than ever before, pent-up demand and increasing consumer confidence, luxury real estate sales surged in 2013 around the world, according to a recent report by Christie’s International Real Estate, the real estate arm of Christie’s art house. The global luxury residential real estate market flourished in 2013, with exceptional increases in the volume of US$1 million-plus market sales. Now in its second year, “Luxury Defined: An Insight into the Luxury Residential Property Market”, presented an in-depth analysis of luxury market trends and compares 10 of the world’s top property markets: Cote d’Azur, Hong Kong, London, Los Angeles, Miami, New York, Paris, San Francisco, Sydney, and Toronto.

Using ‘Christie’s International Real Estate Index,’ markets were ranked across key metrics including record sales price, prices per square foot, percentage of non-local and international purchasers, and the number of luxury listings relative to population. London topped this year’s

Index, with a US$101.5 million top sale and average luxury home sale prices of US$4,683 per square foot.

New York and Los Angeles ranked second and third, respectively, driven by exceptional growth in luxury sales volume. And despite government cooling measures impacting sales volume, Hong Kong still performed strongly, ranking fourth with an exceptional US$83.3 million top sale.

The report identified a number of key trends in each of the top markets, as well as in the broader luxury housing sector globally:

- If 2012 was the year when the highest end of the luxury market came back to life, 2013 was the year when the rest of the luxury market flourished, with robust growth in the number of prime property market sales — 41,700 sales were realized in the US$1 million-plus market during 2013 within the 10 indexed cities, compared to 35,000 in 2012.

- Low interest rates, limited inventory, and pent-up demand drove significantly higher purchases by three prominent buyer groups: local buyers at the lower end of the luxury market, buyers from the millennial age group, and overseas buyers particularly at the top end of the luxury housing market.

- Changes to tax laws and other government market cooling measures impacted some prime property markets, but in general these laws have had little impact outside of Asia and France.Luxury real estate shows a strong correlation with the top end of the fine art market as opposed to the general housing market.

- The luxury home markets that have rebounded the strongest are in urban centers, although prized resort areas have begun to see some of the luxury residential market’s recovery.

- NEW YORK: Experienced significant growth in luxury real estate sales volume despite low inventory.

- LOS ANGELES: Jumped to third position on the Index from sixth in 2012 with the highest sale in the United States (US$74.5 million).

- HONG KONG: Ranked fourth with an exceptional US$83.8 million top sale despite government cooling measures impacting sales volume.

- SAN FRANCISCO: Home sales over US$1 million jumped by 62 percent year-on-year.

While the report focuses on 10 indexed markets, it also provides insight into other key luxury residential areas around the globe including Rio de Janeiro and Singapore as well as prized markets with a population of less than 150,000, such as La Jolla, California; Monte Carlo, Monaco; Punta del Este, Uruguay; and Sarasota, Florida.