Instagram is Beauty’s hottest social platform, with 79 percent of brands in the L2’s Index now present, up from just 29 percent in 2012, according to the fifth-annual L2’s Digital IQ Index: Beauty Report, which analyzes and benchmarks the digital performance of 85 global Beauty brands across Site, Digital Marketing, Social Media, and Mobile over the past year.

“Exploiting new growth channels, Beauty brands are doubling down on digital, and some of these bets are starting to pay off,” according to Scott Galloway, L2 Founder and the co-author of the fifth-annual Digital IQ Index: Beauty Report.

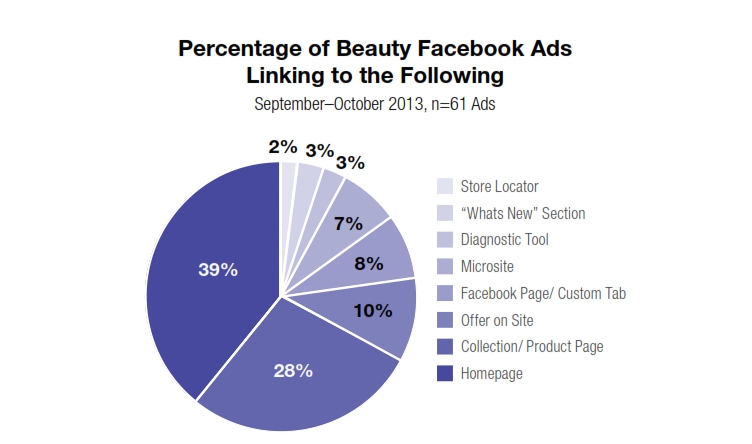

At the time of the study, 41% of Beauty brands were using Facebook’s advertising products. Approximetely 40 percent of Facebook ads linked to the brand’s home page drove to specific site content or collection/product page. Only 8% brands directed the consumer to a destination within Facebook, a huge departure from how Beauty Brands have approached Facebook advertising investments historically.

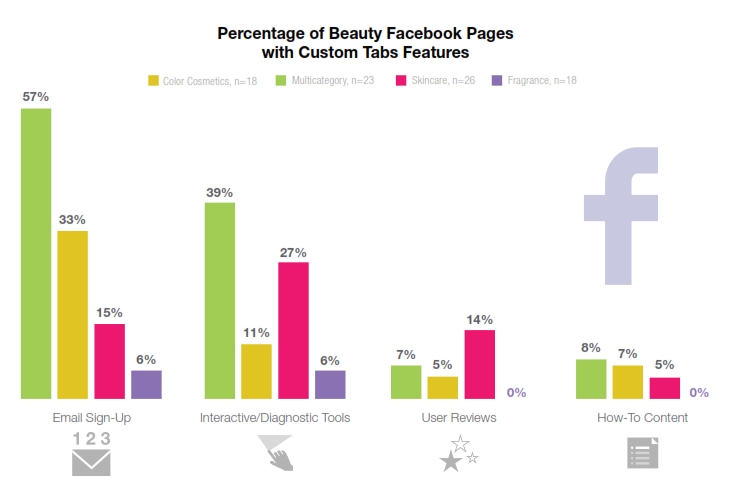

Facebook custom tabs offer Beauty brands a space to educate their fanbases, expand their mailing lists, and drive consumers to the site for purchase. Only 28 percent of Beauty brand Facebook pages enable email opt-in through custom tabs, and less than a quarters have custom tabs that feature interactive tools (22 percent), user reviews (26 percent), or how-to content (20 percent).

However, just 16% of brands were employing retargeted ads during the study period, and less than half of the retargeted ads (38%) led to a specific product. Within six months of launching, Facebook Exchange accounted for 47% of retargeted impressions on the web.

Study Highlights:

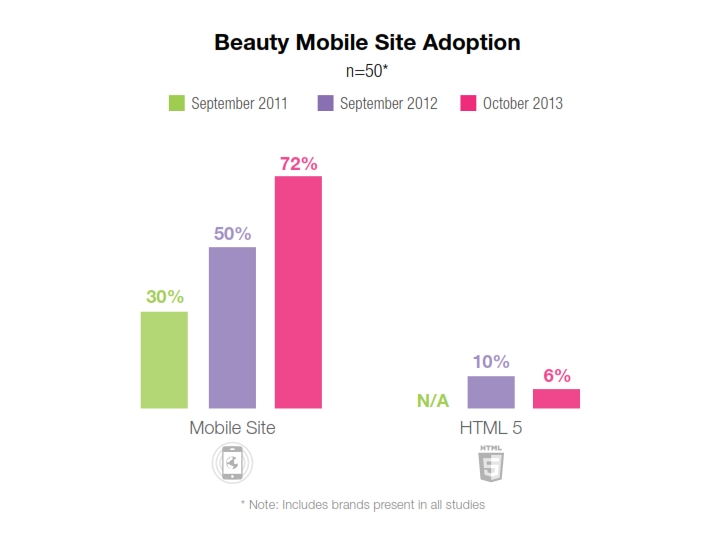

- While mobile app development has plateaued and tablet-specific investments are nascent, nearly three-quarters of Beauty sites are mobile-optimized today—a 50 percent Year over Year (YOY) increase.

- Amazon is the most visible site in Beauty searches, appearing on the first page of organic results for more than 60 percent of skincare, color cosmetics, and fragrance keyword searches.

- Beauty brands’ products are being sold unofficially on Amazon at an average of 30 percent less than MSRP.

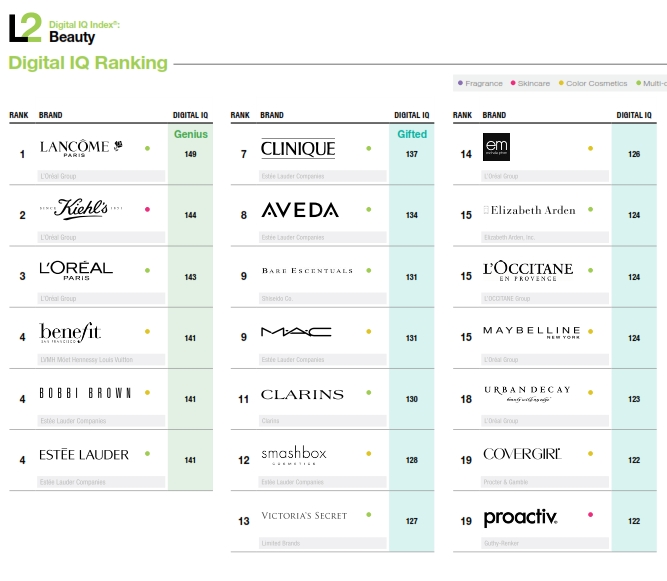

- L’Oréal brands control the Index’s top three spots, the result of significant Year over Year investments.

- Five of the Top 10 brands in this year’s Index belong to Estée Lauder, which maintains the highest average enterprise Digital IQ.

- Kiehl’s, Bobbi Brown, and Benefit Cosmetics punch above their weight class, and are all in the Genius category for the first time this year.

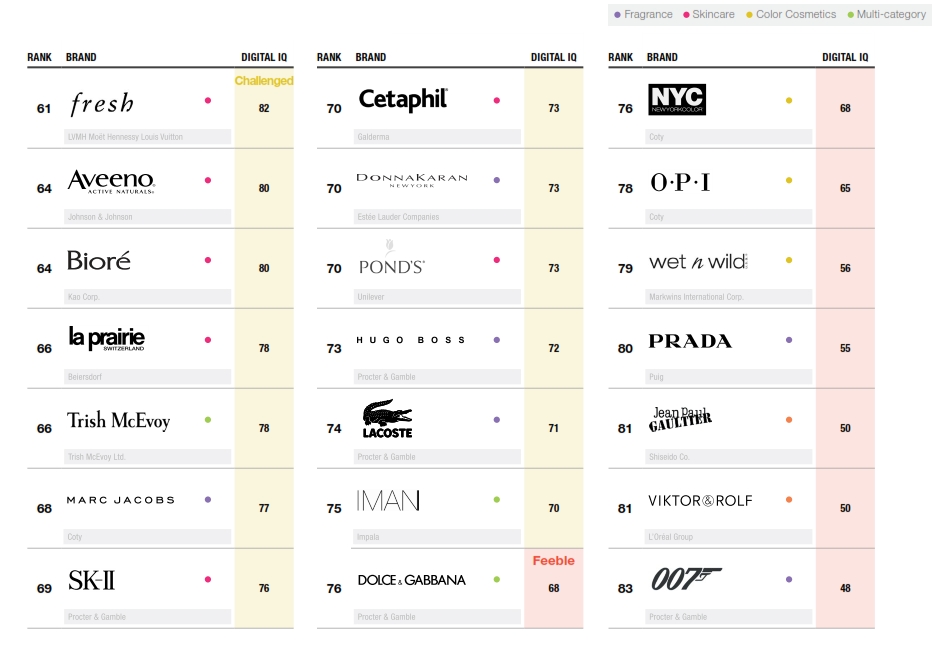

- Fragrance brands lag in the sector, with 60 percent earning Challenged or Feeble scores.

1. Lancôme – digital IQ – genius

2. Kiehl’s – digital IQ – genius

3. L’Oreal – digital IQ – genius

4. benefit – digital IQ – genius

4. Bobbi Brown – digital IQ – genius

4. Estee Lauder – digital IQ – genius

7. Clinique – digital IQ – gifted

8. Aveda – digital IQ – gifted

9. Bare Escentuals – digital IQ – gifted

10. MAC – digital IQ – gifted

11. Clarins – digital IQ – gifted

12. Smashbox – digital IQ – gifted

13. Victoria’s Secret – digital IQ – gifted

14. EM – – digital IQ – gifted

15. Elizabeth Arden – digital IQ – gifted

15. L’Occitane – digital IQ – gifted

15. Maybeline – digital IQ – gifted

18. Urban Decay – digital IQ – gifted

19. CoverGirl – digital IQ – gifted

19. proactiv – digital IQ – gifted

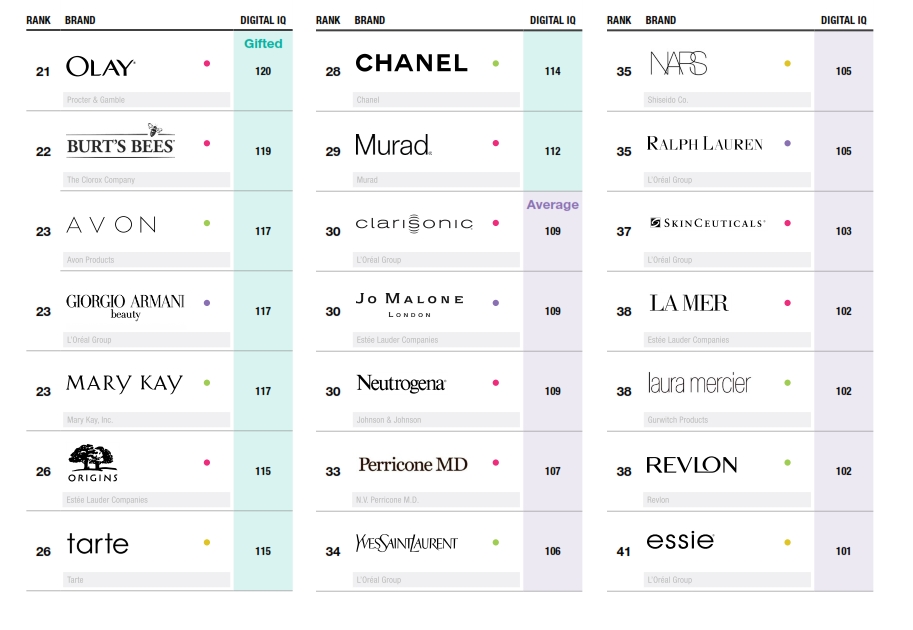

21. Olay – digital IQ – gifted

22. Burt’s Bees – digital IQ – gifted

23. AVON – digital IQ – gifted

23. Giorgio Armani – digital IQ – gifted

23. Mary Kay – digital IQ – gifted

26. Origins – digital IQ – gifted

26. tarte – digital IQ – gifted

28. Chanel – – digital IQ – gifted

29. Murad – digital IQ – gifted

30. clarisonic – digital IQ – average.