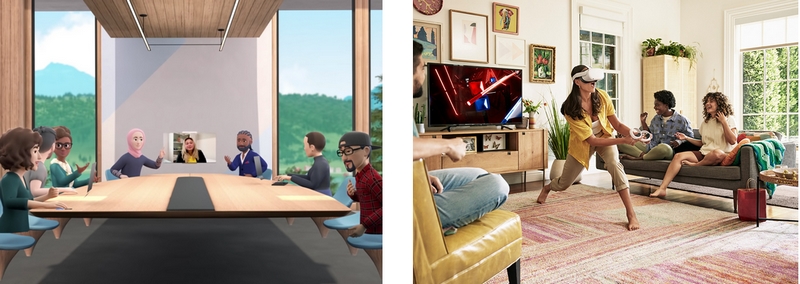

Consumers are increasingly engaging on video chats and thinking to themselves if “it could have been much easier as a phone call”? Especially when that ideo call involved a few people that have no idea how to use a computer, let alone connect to a video. Add in new complications we’ve had to conquer including (but not limited to) sending out electronic invites, downloading new software or applications, troubleshooting/possible delays due to tech issues, giving up personal data, and even paying for services on top of our normal utility expenses, and the plot thickens.

In this post-pandemic era, the vocabulary has changed to from “let’s set a call” to “let’s set up a video conference,” says Ali Hashemian, president of Kinetic Financial. This has been very conducive to the tech industry continuing to drive revenues in this socially trending economy. While Hashemian’s expertise is not related to social media or technology in general; his expertise is in financial planning. So how do we evaluate all these tech trends – and specifically the metaverse – from a financial/investment perspective?

Hashemian goes on to explain, “Don’t get me wrong, I believe that video conferencing technology (particularly the ability to share visual information virtually and remotely) is a very powerful tool in almost every industry. The question isn’t “yes or no” but “when, why, and how.”

“Let’s look back on a couple of historically successful stock stories; I want you to ask yourself those same questions I posed. If you think about Amazon or Tesla, the ‘yes or no’ doesn’t even seem relevant. And the ‘when, why, and how’ have always seemed obvious.

“Let’s fast forward to a more relevant and less obvious example: blockchain (specifically cryptocurrency). The ‘yes or no’ was a lot harder for investors to decipher, and still is. But if you look at the ‘when, why, and how’ there was almost no question. We were at a time that the world was looking for digital assets (when). Other asset classes were peaking, so investors were looking for options but didn’t want to invest in traditional currencies and commodities (why).

Blockchain offered a digital, alternative, and private way to invest (how).

“Let’s look at augmented reality, which was a few years ahead of blockchain. The ‘yes or no’ question feels like most would answer yes. Who wouldn’t want to wear a pair of glasses that can read your text messages aloud to you, record everything you saw that day, and tell you about the temperature in real time?

But if you think from the position of ‘when, why, and how,’ a different picture is painted.

“The truth is, we already had our smart phones which gave us access to all the same information; but instead of all that info being thrust on us constantly through glasses, we get it on demand via our phones. In a time when people want to be in control of the influence technology has on their lives, augmenting reality did not fit our social trends (when). Since we had many options that could give us the same information without the added technology of augmented reality, there was no real practical reasoning to adopt the new tech (why). To utilize augmented reality, you would either need to integrate a new device that would be expensive and possibly change your image, like glasses, or stare through your phone camera for your entire life – pretty unreasonable from a practicality standpoint (how).

“I think it is too early, from an investment standpoint, to determine the financial value of a metaverse. However, it is important to put on your financial goggles (no pun intended) when you decide on a strategy for your money. This may be a good opportunity for you to test your rational investing skills. Does the ‘when, why, and how’ create a demand for a three-dimensional internet existence or are you just following the simplistic investment view of ‘yes or no'”?